【Semi-Private room medical coverage in Asia】Apply WeHealth Prestige to get 6 months premium rebate! Click here

CLIENT LOG ON

Please sign

Not registered? Register

By signing in, you agree to these terms and conditions.

- Please enter a search term.

Regions

-

You are on the Sun Life Financial Hong Kong website. Language selection is English. Expand or collapse region and language section. HONG KONG | 中文

-

Life Moments

Staying healthy

Preparing to retire

Enjoying retirement

Bright Tips

-

Insurance

Limited time offer

Value-added Services

- Overview

- Medical Concierge Services

- Local Urgent Care

- AdvicePro (Face-to-face Second Medical Opinion Services)

- Cashless Arrangement Service

- Mainland China VIP Medical Navigation Service

- Comprehensive Genomic Profiling

- Family Care Benefit

- Cancer and Stroke Family Support Program

- Worldwide Emergency Assistance Benefits

Savings & Life

- Overview

- Fulfillment ratios of respective products

- Dividend and bonus philosophy of respective products

- FlexiRetire Annuity Plan

- Foresight Deferred Annuity Plan

- Generations II

- LIFE Brilliance

- One / Five Year Term Plan II

- Ruby Endowment Plan 3/8

- SaveFast Endowment Plan

- Stellar Multi-Currency Plan

- SunGift

- SunGift Global

- SunGuardian / SunGuardian (Care Version)

- SunJoy

- SunJoy Global

- SunProtect

- Venus II

- Victory

- Vision

- Vital

Voluntary Health Insurance Scheme (VHIS)

Accident & Disability

Universal Life

Group Insurance

-

MPF & ORSO

ORSO fund prices & performance

* Sun Life MPF Master Trust has been merged into Sun Life Rainbow MPF Scheme from 30 August 2023

# Sun Life MPF Basic Scheme and Sun Life MPF Comprehensive Scheme have been merged into Sun Life Rainbow MPF Scheme from 29 November 2023

-

Invest

Quick links

Investment-linked Assurance Scheme

Asset Management

-

About us

Quick links

Who we are

Newsroom

Market Insights

Tools & Resources

- Overview

- Digital insurance experience

- My Sun Life HK Client Digital Platforms

- Retirement Calculator

- My Sun Life HK – Group Health app

- Education Budget Calculator

- Bright Solutions

- Cost estimator of treating major illnesses

- First Contribution Calculator

- Investment Risk Assessment

- Retirement Savings Calculator

- Expense Calculator

- Savings Planning Calculator

- Please enter a search term.

-

HONG KONG | 中文

Regions

RegionsLanguages -

Life Moments

-

Insurance

- Back

- Insurance

- Insurance overview

- Limited time offer

-

Value-added Services

- Back

- Value-added Services overview

- Medical Concierge Services

- Local Urgent Care

- AdvicePro (Face-to-face Second Medical Opinion Services)

- Cashless Arrangement Service

- Mainland China VIP Medical Navigation Service

- Comprehensive Genomic Profiling

- Family Care Benefit

- Cancer and Stroke Family Support Program

- Worldwide Emergency Assistance Benefits

-

Savings & Life

- Back

- Savings & Life overview

- Fulfillment ratios of respective products

- Dividend and bonus philosophy of respective products

- FlexiRetire Annuity Plan

- Foresight Deferred Annuity Plan

- Generations II

- LIFE Brilliance

- One / Five Year Term Plan II

- Ruby Endowment Plan 3/8

- SaveFast Endowment Plan

- Stellar Multi-Currency Plan

- SunGift

- SunGift Global

- SunGuardian / SunGuardian (Care Version)

- SunJoy

- SunJoy Global

- SunProtect

- Venus II

- Victory

- Vision

- Vital

- Voluntary Health Insurance Scheme (VHIS)

- Medical & Critical Illnesses

- Accident & Disability

- Universal Life

- Group Insurance

-

MPF & ORSO

- Back

- MPF & ORSO

- MPF & ORSO overview

- MPF Scheme

- ORSO Scheme

-

MPF fund prices & performance

- Back

- MPF fund prices & performance overview

- Sun Life Rainbow MPF Scheme price & performance

- Sun Life MPF Master Trust price & performance*

- Sun Life MPF Basic Scheme price & performance

- Sun Life MPF Comprehensive Scheme price & performance

- * Sun Life MPF Master Trust has been merged into Sun Life Rainbow MPF Scheme from 30 August 2023

- ORSO fund prices & performance

-

Invest

- Back

- Invest

- Invest overview

- Investment-linked Assurance Scheme

-

Investment-linked Fund Prices & Performance

- Back

- Investment-linked Fund Prices & Performance overview

- SunFortune

- SunArchitect

- SunWish

- SunFuture II

- SunFuture

- SunWealth

- SunAchiever

- FORTUNE Builder

- Rainbow Graduate

- Rainbow Retirement

- Rainbow Wealth Master

- ANNUITY 100 Retirement Plan

- FORTUNE

- Rainbow Saver/Rainbow Investor

- Star Select Investment Plan

- Asset Management

-

About us

- Back

- About us

- About us overview

- Who we are

- Newsroom

- Become an advisor

- Corporate responsibility

- Market Insights

- Become an employee

-

Tools & Resources

- Back

- Tools & Resources overview

- Digital insurance experience

- My Sun Life HK Client Digital Platforms

- MPF mobile app

- Retirement Calculator

- My Sun Life HK – Group Health app

- Education Budget Calculator

- Bright Solutions

- Cost estimator of treating major illnesses

- First Contribution Calculator

- Investment Risk Assessment

- Retirement Savings Calculator

- Expense Calculator

- Savings Planning Calculator

- Client support

-

Claims

- Contact us

- Chatbot “Sunny”- Terms & Conditions

Client eNewsletters

-

About us

- About us overview

- Who we are

- Newsroom

- Become an advisor

- Corporate responsibility

- Become an employee

-

Tools & Resources

- Tools & Resources overview

- Digital insurance experience

- My Sun Life HK Client Digital Platforms

- MPF mobile app

- Retirement Calculator

- My Sun Life HK – Group Health app

- Education Budget Calculator

- Bright Solutions

- Cost estimator of treating major illnesses

- First Contribution Calculator

- Investment Risk Assessment

- Retirement Savings Calculator

- Expense Calculator

- Savings Planning Calculator

- Market Insights

- Contact us

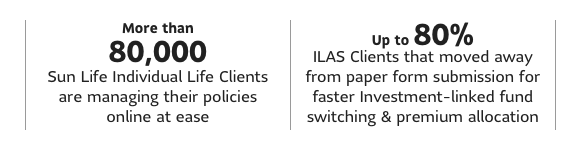

Always connect with you for better client experience

At Sun Life, we are totally client focused and committed to providing a personalized service to all our Clients. Meanwhile, we always connect with you – read the latest edition of our eNewsletter and learn more about our well-thought-out services.

- 2019

- 2020

- 2021

- 2022

- 2023

- 2024

We care. We listen actively.

At Sun Life, our “Client for Life” strategy guide how we act and behave. They highlight how we deliver on our promise and value proposition, and strive to show our clients we care and value them by consistently exceeding our client expectations at every touchpoint throughout their client journey. The best way to do this is by listening to what our clients tell us how we are doing.

Online Survey

We measure the quality and level of satisfaction of the services provided by our advisors and service team with a quick client service feedback survey. We send online survey randomly to clients via SMS after interaction with our advisors and the service team. We analyze the feedback to identify areas that need improvement, and collect interesting ideas from our clients and share these insights across the company.

In App Feedback Form

My Sun Life HK app becomes an encompassing digital hub for our clients to view their policy and coverage information, perform self-services as well as to receive timely communication from us. We built an in-app feedback form that prompt our clients to provide feedback when they are leaving the app. Our client service representatives will proactively contact our clients if any clarification or follow up is required.

By actively listening to the voice of our clients, we understand the needs of our clients and enhance our services and solutions we offer to clients and become more proactive and predictive in anticipating their needs to provide a seamless experience.

Retire Smart: Foresight Deferred Annuity Plan

Carefree retirement is a universal dream. As lifespans increase, retirements are also getting longer. Is there a way to ensure that we can retire when we want, the way we want?

Sun Life has always been committed to understanding the needs of our clients and offering customized products that suit their different life stages. Everyone has a retirement dream; some want to retire early, others later, while some wish for simplicity and others desire luxury. Only a flexible insurance product can satisfy everyone’s unique need and help them plan their ideal retirement. That is why we launched the Foresight Deferred Annuity Plan, which offers options for the premium payment term, Annuity Start Age and Annuity Period. With as many as 56 possible combinations, you can mix and match to create the perfect plan for you! The Foresight Deferred Annuity Plan provides a steady stream of monthly income to help make your retirement dreams come true.

Learn more about the Foresight Deferred Annuity Plan now!

eContract: Make it Easy for you

Hardcopy policy contract was a mainstay in the past insurance experience. It is time-consuming waiting for postal delivery. Moreover, if you forget where you placed the policy contract, you have to go through the hassles searching the whole house when you need it.

We understand your needs, and now, we have enabled My Sun Life HK app to allow you to get instant access to your multiple policies anywhere anytime, in a safe and convenient way. It takes only seconds to retrieve the policy eContract and view the policy details, including family coverage. It is also environmental friendly and no more worries on misplacing the policy contract!

Payout Services: Now is Faster & Easier

Long waiting for cheque delivery? Hassles to bank in the cheque?...We listen, and we are here to offload the administrative burden from our clients and let them focus on things that matter.

You can now request to transfer the local money via Faster Payment System hosted by the Hong Kong Monetary Authority (“FPS”) directly into your defaulted bank account*. We are now extending this FPS service to some of our regular Policy Value payouts, which including Dividends, Coupons and Maturity Benefit, etc.

Just opt for the Policy Value payout services via FPS – faster and easier. It’s that simple!

*The FPS account and bank account for local money transfer must be registered under the Policy Owner of exact name match.

Voice from our clients: How we can help

We would love to share about client’s real experience and how someone in our team made something easier, quicker or special for them. We will continue to build on what we do well!

Story 1: Client Service team proactively understand the needs of clients and provide appropriate solutions

In early March this year, a 60-year-old client called us to inquire about our surrender procedure. Our client service officer, Miss Sze asked our client about the reason for policy surrender in hope of learning what we can do better and later realized that our client had retired and urgently needed money. She thought that policy surrender was the only solution. After understanding our client’s need, Miss Sze noticed that her policy would be paid-up at the end of March 2019 and would continue to enjoy life coverage with dividends and coupons until 100 years old. If client applied surrender at that time, client will not only lose the protection, but also lose the dividends and coupons distributed in the future.

Miss Sze explained the policy features to our client and she realized that a coupon of HK$250,000 was going to distribute on her policy in a few days. The amount was sufficient to meet the financial needs of the client, thus she decided to withdraw dividends and coupons.

Client said that she highly appreciated Miss Sze’s service and taking the time to understand her needs, and provided her with the most appropriate solutions to overcome the difficulties and deeply feel our support and care for each client and their family!

Story 2: Not feeling well? Our Efficient Hospital Cashless Service can help you!

What if you get ill? What kinds of chaos will you face? You may firstly need to visit a doctor and then find a hospital for treatment and meanwhile may get unemployed. Even after discharged, you may need to pay an unaffordable bill! We know it may not be a comfortable experience for most of us and especially for a person in sickness. Our hospital cashless service provides a rapid arrangement before you admit to a hospital. This can definitely help you to make you feel safe and take care about your financial needs.

Miss Lee (nickname) noticed an abnormal breast mass in June 2019. She then went to examine her condition by fine needle aspiration and clinical results showed it was a malignant tumor. Fortunately, Miss Lee has bought our high-end medical insurance plan and arranged a hospital cashless service before admission. We noted the policy only inforce for just two years and this may need client to provide further document before approval. But we care about Miss Lee’s worries and preference to admit to a hospital as soon as possible. Our Claims Manager followed up the case overnight and Miss Lee’s case finally approved before her admission in a short period of time. Under our hospital cashless arrangement, Miss Lee would stay in one of the best private hospitals in Hong Kong without worry to pay the bill that could cost up to several hundred thousand dollars or submit Claims files afterwards.

Claims specialists talking about the Voluntary Health Insurance Scheme (“VHIS”)

It is well-known that VHIS covers a wide issue age range and allows for tax deduction. However, from the claims perspective, how would claims specialists see this new plan and what are the exclusive advantages?

Our experienced claims specialists are always trying their best to aid our clients whenever our clients have unexpected needs. “It has been discouraging to be unable to help individuals when they are undergoing non-surgical cancer treatments (chemotherapy and targeted therapy) or psychiatric inpatient treatments that might not get covered due to the restrictions under traditional medical plans across the market,” said our specialist. However, these treatments are now generally under coverage when it comes to VHIS. We are glad to roll out our new VHIS Flexi Plan, WeHealth Plus, offering a no claim discount to healthy clients and cardiac rehabilitation treatment benefits to those in need. We have been receiving enquiries and many were from younger people who want to buy insurance for their parents - learn more about the WeHealth Plus now.

Your phone is the shortcut to all you want to know about your policy

We know waiting is never easy especially during tough times. Want to know immediately if your plan covers the surgery that your doctor just suggested? Wish to keep posted while waiting for the result after submitting a claim? Only got time to review the coverage of your family members at midnight? All of these are just an app away – view your policy eContract and family coverage in My Sun Life HK app, upload your documents and submit your claim at one go, and keep track of the status.

Besides, you may also visit our Claims Page and find out the documents required for claim submission and download forms.

.jpeg)

Payment and insurtech adaptation, both got instant with Sun Life

With us, the very first insurance company in Hong Kong adopting the Faster Payment System (FPS) in our claims services, not only can you pay your friend instantly after a meal, you may now also receive your claims payment within 24 hours at the earliest* if you submitted your application through eClaims. One of our clients even got his in 2 minutes after filing a claim! Digitalizing the claims process is an important move to the betterment of the environment and more importantly, it enables us to focus on understanding and fulfilling your needs.

*Only for Individual accident benefits. Documents and information provided shall be complete and valid, and submitted via My Sun Life HK mobile app; clients should have selected to receive claim payments via Hong Kong Monetary Authority’s Faster Payment System (“FPS”). Subject to terms and conditions of FPS and My Sun Life HK mobile app.

We want you to get the protection you deserve

Putting clients at the centre of what we do, our claims specialists work hard on handling every single claims case efficiently and understand that human touch is extremely important when it comes to special circumstances. We look to offload the administrative burden in the claims process from our clients and their family and let them focus on things that matter.

There was once an aged client, insured for years with us who passed away due to an accident. Taking a wide range of factors and the urgency of the situation into account, we decided to exercise discretion for financial support and settled the payment much earlier than it should have been. Another client of ours had to submit a large number of documents to support her claim due to her special situation while both the insured and the beneficiary of the policy had passed away. We know that it was an extremely difficult time for her, and it was hard to obtain all the required documents on her own – so our specialists acted immediately to allay her concerns about the uncommon circumstance and kept track of the status with her financial advisor while collecting necessary reports from the hospitals directly. Being able to help our clients and settle the case could not have been more rewarding.

Awarded and Rewarded: Better experience for you

We buy insurance to minimize our loss when it comes to unfortunate happenings. The Sun Life Hong Kong claims specialists know that our mission is much more important than adjudicating claims. That is why we have always been stretching our vision to be client-centric. We are so much honored to receive the Excellence Award (Claims Management) in the Financial Institution Awards 2019 organized by Bloomberg Businessweek/Chinese Edition. This encouraging moment marks a significant milestone in our multi-year digital transformation journey, and we will move forward to further simplify and optimize our client journey with My Sun Life HK app, enabling you to manage your coverages and submit claims as you need.

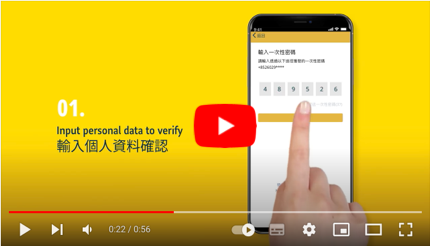

Explore the New My Sun Life HK Portal

It’s here – the brand-new My Sun Life HK Portal which will replace the Individual Life e-Services. While keeping the existing functions, many new features and policy details will be added. By using this portal, you will get a comprehensive view of your policies updates timely.

New Interface: The new design is based on that of My Sun Life HK app, which provides you with a simple and user-friendly interface. You are able to view details of your policies effortlessly, with all coverages, policy values and savings collected on one portal.

Supports Different Devices With No Location Limits: No matter where you are, you can always view your policies on-the-go on your mobile phones, tablets or laptops.

eContract Service: Your policy details and documents, including policy contracts, anniversary statements and billing notices, are available under “My Policies” section. This service also enables you to acknowledge your contracts via your devices, as well as send policy documents to your email for future reference. It is simple, easy and environmentally-friendly!

Policy Service Requests: Simply apply on the Portal for policy services, such as updating your personal information. It only takes a few minutes to submit your fund switch or edit future premium allocation requests, which is much faster than traditional paper submission.

A lot more features will be added. Ready to explore more? Access My Sun Life HK Portal now to experience the convenience brought by technology, and start your go-green journey!

Working From Home: Non-regular Eating Habits May Lead to Weight Gain and Increased Risk of Diabetes

A lot of you had the experience of working from home due to pandemic. Exercising home office has led to changes of our habits - more cooking ormore takeaways during the past months. Back in September, we commissioned to ESDlife and carried out the “Changing Eating Habits of Hongkongers during COVID-19” survey, in which 916 local respondents aged between 20 and 55 were interviewed through online questionnaire. The survey revealed that the eating and exercising habits had drastically changed for most of the Hongkongers during COVID-19.

Hongkongers Consumed More Snacks and Gained Weight During Pandemic

Part of the results of the “Changing Eating Habits of Hongkongers during COVID-19” survey are listed below (please refer to the appendix for details):

- Weight gain: 55% of the respondents gained weight during pandemic.

- Ordered takeaway more frequently: 72% of the respondents ordered takeaway during pandemic, and 33% of them have ordered more frequently than ever.

- Consumed more snacks: 43% of respondents consumed more snacks in this period, and the top 3 favorite snacks were potato chips, biscuits and ice cream. On average, they ate snacks 3 times a week.

- Multiple meals: 95% said they had 4 to 5 meals a day. 54% of the male respondents explained that working at home means there is no fixed dining time; 52% of the female respondents implied that food is their dose for relieving depression, and female has a higher dependency than male in terms of food as a relief.

- Reduced exercise: 41% of respondents had no exercise habits at all; only 8% of respondents exercised for 150 minutes or more a week.

Hongkongers Are Generally Not Knowledgeble of Diabetes

Registered dietitian Vivien Lau suggested that unbalanced diet in addition to lack of exercise lead to weight gain, as well as increased risk of getting diabetes. The survey revealed that many Hongkongers still show misunderstandings about diabetes, thinking it relates solely to sugar consumption. Respondents mistakenly believe frequent consumption of sugar-rich drinks and foods will cause diabetes, and diabetic patients should avoid eating rice and get rid of all foods containing sugar and starch.

Lau also highlighted that instead of sugar intake solely, overweight or obesity and lack of exercise play major roles causing Type 2 diabetes. Since there is excessive body fat on people who are overweight or have obesity, insulin resistance may happen on body cells, resulting a higher blood sugar level. Every 9 out of 10 Type 2 diabetes patients are also suffering from overweight or obesity, with the condition namely “Diabesity”.

To maintain a healthy blood sugar level, Lau recommended Type 2 diabetes patients to eat carbohydrates with low glycemic index level for stabilizing blood sugar condition, coupled with cardio and resistance exercise to consume more calories and enhance body sensitivity to insulin.

Heathy Eating Tips For Takeaways

To maintain a healthy diet in general, Lau suggested following tips:

- Choose fresh ingredients such as shredded and sliced meat instead of processed meat which contains more saturated fat. Excess consumption of saturated fat for a long period of time may affect body weight and cardiovascular health.

- Avoid drinking noodle soup and ensure to drink enough water for excreting excess sodium from the body. Excess consumption of sodium for a long period of time may affect blood pressure, and the body is more prone to edema.

- Avoid eating skin, brisket and bone of meat less as they contain more fat. Rich in protein and with less saturated fat, fish and seafood are better meat options.

Appendix

Table 1: Changes of eating habits of Hongkongers during COVID-19

| Changes of eating habits | Percentage* | |

| 1 | More snacks | 43% |

| 2 | More cooking besides preparing regular meals | 35% |

| 3 | More afternoon tea or late-night supper | 23% |

| 4 | Multiple meals a day | 18% |

*Can choose multiple answers

Table 2: Hongkongers’ top 5 snacks during pandemic

| Rank | Snack(s) | Percentage* | Average per week | Calories / kcal |

| 1 | Potato chips / prawn crackers | 56% | 3.2 times | 530 |

| 2 | Biscuits / cookies | 46% | 3.7 times | 410 |

| 3 | Ice cream | 39% | 2.7 times | 210 |

| 4 | Chocolate | 32% | 3.3 times | 540 |

| 5 | Cakes | 31% | 2.5 times | 360 |

*Can choose multiple answers

Healthy snack options recommended by registered dietitian Vivien Lau: original flavored nuts, sugar-free dried fruits or freeze-dried fruit slices, high fiber cereal bars, lower-calorie baked potato chips, salted popcorn.

Table 3: Exercise habits of Hongkongers during COVID-19

| Age | No exercise habits | 150 mins or above / week |

| Under 25 | 67% | 8% |

| 25 – 29 | 48% | 8% |

| 30 – 34 | 46% | 5% |

| 35 – 39 | 43% | 5% |

| 40 – 44 | 42% | 6% |

| 45 – 49 | 35% | 12% |

| 50 or above | 26% | 15% |

Table 4: Takeaway recommendations and healthy eating tips from registered dietitian Vivien Lau

Takeaway |

Healthy eating tips |

Breakfast

|

Processed meat such as ham, sausage and luncheon meat contain more saturated fat. Excess consumption of saturated fat for a long period of time may affect body weight and cardiovascular health. Fresh ingredients such as shredded and sliced meat are highly recommended meat options. To reduce oil absorption, replace scrambled eggs with poached eggs or fried eggs and choose toasts without butter. |

Lunch

|

Noodle soup served in restaurant usually contain more sodium. Drinking the soup base is thus less recommended. Also ensure to drink enough water for excreting excess sodium from the body. Excess consumption of sodium for a long period of time may affect blood pressure, and the body is more prone to edema. |

Dinner

|

We should eat skin, brisket and bone of meat less because they contain more fat. Rich in protein and with less saturated fat, fish and seafood are better meat options. |

Source: Sun Life Hong Kong’s “Changing Eating Habits of Hongkongers during COVID-19” survey.

All information contained in this article shall only be used as general reference and general health knowledge for sharing purposes. The statistical data of this article is obtained from a survey conducted by a Survey agent commissioned by Sun Life Hong Kong. All information contained in this article is not intended to provide any forms of guarantee or medical advice, and does not constitute a solicitation of an offer or offer, and shall not be regarded as the basis for any contract, to sell or to purchase any insurance products. The view contained in this article may be changed at any time without prior notice. Information is provided base on sources believed to be reliable, Sun Life Hong Kong Limited (a company incorporated in Bermuda with limited liability), its associated companies and their directors and employees (collectively “Sun Life Hong Kong”) gives no express or implied warranty, guarantee or represent its accuracy, effectiveness, completeness of the same. Sun Life Hong Kong accepts no liability whatsoever for any loss or damage arising from use of any information or opinion herein. This article is owned by Sun Life Hong Kong. Modification or change is not allowed without the Sun Life Hong Kong’s prior consent. This article is intended to be distributed in Hong Kong only and shall not be construed as an offer to sell or a solicitation to buy or provision of any products of Sun Life Hong Kong outside Hong Kong.

Understanding Global Investment Trends via “Macro Observation” video

Do you know what the global trends and hot topics are among international investors? Watch the “Macro Observation” videos, hosted by our Chief Investment Strategist, Mr. John Lui, for more insights and news on investment trends. You can also access other economic-related information on the same webpage to get yourself prepared for the upcoming year.

Click here to view the October and November editions (in Cantonese, with Chinese and English subtitles). You are also recommended to read the quarterly-updated “market navigator” and investment-related articles which are updated monthly.

Learn more about the world economy with us now!

Note: All videos and article content are issued by Sun Life Asset Management (HK) Limited. They are only for general information sharing and do not constitute any investment opinions. This is neither an invitation of investment nor agreement to make any product purchases.

Where Is The Ideal Place For Your Retirement?

As our average life expectancy increases, so does our retirement durations. For retirees who seek a place to spend their next chapter is a hot topic. How does it feel like spending your golden age aboard? Would moving to Europe, North America, Australia, Mainland China or staying in Hong Kong suit your lifestyle?

Click here to view the article to get a sense of your retirement life and have a comprehensive retirement plan in advance!

Want To Enjoy Your Retirement? Start Planning Now

As an employee, have you ever had this thought in your mind: Why would I bother or have time to think about my retirement when I need to work overtime every single day, and I am still young.

It is never too early to plan your retirement. You should start doing so even if you still have a long way to go.

Try our Retirement Calculator now! Spend a few minutes to figure out how much you need to save, and how far you are from your retirement goal. Start planning ahead to achieve your dream retirement easier!

Worry No More! COVID-19 Test Arranging Service To Ease Your Concerns

Due to another outbreak of COVID-19 recently, from now until 30 September 2020, we can help you to arrange a screening test appointment at designated clinics in order to ease your health concerns.

This appointment service is applicable to all individual life clients. You can take a Deep Throat Saliva Test provided by JP Partners Medical or Virtus Medical . For appointment details or any assistance required, please contact your advisor.

Stay safe and we wish you all good health!

Note: The testing service is provided by third-party service providers. We will review the service from time to time and may change third-party service providers without prior notice.

Nail Online School Interviews Under COVID-19

In the time of pandemic, more primary schools will be conducting online interviews instead of traditional face-to-face interviews. It is something new to children, meanwhile beneficial in the way that parents’ presence can give them sense of security.

How should parents prepare their children for admission interviews? How to manage their emotions and keep them focused during the interview? The experts believe that Effective EQ (Emotion Quotient) Management is the key to ensuring a successful online interview. Click here to view the smart tips from the experts on how to master online school interview!

Macro Observation: Quick Investment Tips For You

A few months to go for 2020 - It has been an extremely tough year for the whole world. In the midst of the pandemic, crude oil war and other events that had shaken the global economy, it is important to know what is happening all over the world and be prepared for the unpredictable future.

Don’t forget to watch the monthly “Macro Observation” videos, brought to you by Mr. John Lui, our Chief Investment Strategist. In just 4 minutes, you will get to know more about the investment world as John talks about global economy trends, and shares useful investment tips and knowledge.

You can revisit the July and August editions here (in Cantonese, with Chinese and English subtitles). You can also find informative materials such as “market navigator” and investment-related news on the same page.

Click here now to explore the investment world with us.

Note: All videos and article content are issued by Sun Life Asset Management (HK) Limited. They are only for general information sharing and do not constitute any investment opinions. This is neither an invitation of investment nor agreement to make any product purchases.

Present or Future? We Have Both Covered

Present? Future? You can have it both ways.

Sun Life has your retirement life covered. We provide various retirement plan options which combine MPF, health protection and wealth accumulation. Our new participating insurance plan Victory helps you achieve potentially high long-term asset growth at affordable premiums, and let you pass your wealth to the next generations.

From now until 30 September, you can enjoy up to 16% premium rebate on Annualized First Year Premium (AFYP) upon successful application of Victory, which meets the following requirement on AFYP, premium payment term and premium payment mode:

For more details including product features, risk disclosure and investment philosophy, please refer to the product brochure, promotion leaflet and sample policy document, or contact your advisor.

Play our Facebook Messenger game for retirement tips and rewards

Want to win a prize and get retirement tips? Participate in Sun Life’s interactive game on Facebook Messenger now, featuring actor Kenneth Ma, to receive useful advice for a bright retirement life. You can also test your luck and even bring home a prize (total worth almost HKD40,000)! Click here to learn more.

Grow Your Wealth With Our Triple Offers

Most common reason to purchase insurance: to provide the biggest support to yourself and your family at the most difficult times. What about growing your wealth at the same time? Enjoy our triple offers specially prepared for you and start to accumulate your reserve for the future now!

Offer 1: Venus (New Product) – 2.5% Premium Discount

Venus is our latest participating insurance plan that can assist you to accumulate wealth stably with flexibility and security for legacy planning. By just one single premium payment at the beginning of the plan, you can achieve long-term wealth growth without incurring transaction costs. Your wealth may even multiply before passing to the next generation!

From now until September 30 2020, enjoy a 2.5% premium discount on single premium paid if you successfully apply for Venus and the policy is issued on or before 31 December 2020.

For details, please refer to our product brochure and promotion leaflet .

Offer 2: SunWish – Bonus Reward Offer

(Unless otherwise defined herein, capitalized terms use in this leaflet shall have the same meaning as those defined in the offering document of SunWish.)

Important Notes

- SunWish (the ‘Plan’), being an investment-linked assurance scheme (‘ILAS policy’), is an insurance policy issued by Sun Life Hong Kong Limited (‘the Company’). Your investments are therefore subject to the credit risks of the Company.

- The contributions paid by you towards this Plan will become part of the assets of the Company. You do not have any rights or ownership over any of those assets. Your recourse is against the Company only.

- Your return on investments is calculated or determined by the Company with reference to the performance of the underlying funds/assets.

- The Death Benefit of the policy is subject to investment risk, it may be significantly less than the premium paid.

- The return of investments under this Plan shall be subject to the charges of the scheme and may be lower than the return of the underlying funds. If you want to know more about the detail of the fees and charges of the Plan, please refer to the offering documents of the Plan. For percentage of total premiums for covering the total fees and charges at the plan level, please refer to the Product Key Facts Statement of the Plan.

- Early surrender or withdrawal of this Plan may result in a significant loss of principal and/or bonuses awarded. Poor performance of underlying funds/assets may further magnify your investment losses, while all charges are still deductible.

- The investment-linked funds available under the scheme can have very different features and risk profiles. Some may be of high risk.

- ’Underlying Funds’ available for selection are the funds listed in the Investment-Linked Fund Guide. These may include funds authorized by the SFC pursuant to the Code on Unit Trusts and Mutual Funds (‘UT Code’), but may also include other portfolios internally managed by the Company on a discretionary basis not authorized by the SFC under the UT Code.

- You should not purchase this product unless you understand it and it has been explained to you how it is suitable for you. The final decision is yours.

- Investment involves risks. You should not rely on this material alone. Please read the offering document of this Plan carefully including Product Key Facts Statement and Principal Brochure (which consists of the Product Brochure and the Investment-linked Fund Guide) for further details including risk factors.

Features of SunWish:

- This is a single contribution investment-linked insurance plan, subject to a minimum single contribution requirement of USD8,000.

- The death benefit amount, equivalent to 105% of your policy value, will be payable in a lump sum to the designated beneficiary in the unfortunate event of the insured’s death.

- You may receive a Top-up Bonus at the end of 1st policy year as well as an annual Loyalty Bonus starting from the end of 4th policy year, subject to conditions. The Top-up Bonus and Loyalty Bonus form part of the policy value and are subject to applicable fees and charges as described in the offering documents of the Plan.

- Partial cash withdrawal can be made at any time subject to conditions, and an Early Encashment Charge of up to 8.5% of the requested withdrawn amount will apply if partial withdrawal is made in the first 4 policy years.

- An Early Encashment Charge of up to 8.5% of the policy value will also be applied if you surrender your policy in the first 4 policy years. As a result, you may suffer from a significant loss of principal and/or bonuses awarded (if any).

- The Plan is subject to charges including Administration Charge, Early Encashment Charge, Management Charge and Underlying Fund Charges.

(For more details of the product features including fees and charges, please refer to the offering documents of SunWish.)

Bonus Reward

From 1 July 2020 to 30 September 2020 (the ‘Promotion Period’), both dates inclusive, customers who successfully apply for this Plan with single contribution of USD25,000 or above, and the policy is issued on or before 30 October 2020, may enjoy the following Bonus Reward in addition to the existing Top-up Bonus*, in the form of additional notional unit(s) of investment-linked fund(s) (the “Additional Notional Units”)under the Plan. Bonus Reward will form part of the policy value and is subject to applicable fees and charges as described in the offering document of the Plan. The Bonus Reward will be calculated based on the single contribution amount listed in the table below and is subject to the Terms & Conditions set out below.

Note: The above bonus rates do not represent the rate of return or performance of investment of your policy.

* For details of Top-up Bonus, please refer to section ‘Dual Bonuses’ in the Product Brochure of SunWish.

Illustrative Example of Bonus Reward calculation

1. Figures in the above examples are hypothetical and for illustrative purpose only.

2. Please note that Bonus Reward claw back may be applicable under certain situation. Please see below for illustrative examples of Bonus Reward claw back.

The customer will not be entitled to the Bonus Reward if (i) cash withdrawal is made from the policy(ies) or (ii) the policy(ies) is/are surrendered or terminated before the Bonus Reward(s) is/are credited to the policy(ies). If policy(ies) is/are surrendered or terminated within the first policy year, the original value of the Bonus Reward credited to the policy(ies) and positive investment return from the Bonus Reward (if any) will be clawed back at the time when the policy(ies) is/are surrender or terminated. The Bonus Reward to be clawed back is the higher of (i) prevailing market value of the Additional Notional Units at the time of claw back; and (ii) original value of the Additional Notional Units credited. Please refer to the examples stated below.

Illustrative examples of Bonus Reward claw back

Example 1: If policy(ies) is/are surrendered or terminated within the first policy year, the Bonus Reward credited to the policy(ies) will be clawed back. Please note that this example assumes that the prevailing market value of the Additional Notional Units at the time of claw back is higher than the original value of the Additional Notional Units credited.

^ The prevailing market value of the Additional Notional Units is clawed back since it is higher than the original value of the Additional Notional Units credited at the time of claw back.

Example 2: If policy(ies) is/are surrendered or terminated within the first policy year, the Bonus Reward credited to the policy(ies) will be clawed back. Please note that this example assumes that the original value of the Additional Notional Units credited is higher than the prevailing market value of the Additional Notional Units at the time of claw back.

# The original value of the Additional Notional Units credited is clawed back since it is higher than the prevailing market value of the Additional Notional units at the time of claw back.

For details, please contact your financial consultant.

Terms & Conditions:

- The above offer is only applicable to any new application(s) of the Plan submitted within the Promotion Period and such policy(ies) must be issued by the Company on or before 30 October 2020.

- For the purpose of determining the amount of Bonus Reward, the single contribution is the amount stated in the policy summary issued to the customers.

- If the customer applies for more than one policy of the Plan within the Promotion Period, the Bonus Reward is to be determined separately for each policy.

- The Bonus Reward will be credited to the customers’ policy(ies) within December 2020 (the exact date will be determined by the Company) in the form of the Additional Notional Units according to the customers’ latest executed investment-linked fund allocation instruction(s) on condition that the policy(ies) is/are still in force at the time when Bonus Reward is credited. The Bonus Reward is not convertible for cash.

- The amount of single contribution will be rounded to the nearest dollar for Bonus Reward calculation.

- A customer notification letter will be sent to the eligible customer after the Bonus Reward is credited to the policy(ies).

- Bonus Reward will form part of policy value and is subject to applicable fees and charges as described in the offering document of the plan.

- The above offer is subject to availability at the discretion of Sun Life Hong Kong Limited. Sun Life Hong Kong Limited reserves the right to vary, suspend or cancel the offer and amend the terms and conditions at any time without prior notice. For application of the Plan submitted before variation, suspension or cancellation of the offer, customers will still be entitled to the original offer. In the event of any dispute, the decision of Sun Life Hong Kong Limited will be final.

This leaflet contains general information only and shall not be construed as an offer to sell any policy(ies). For information of the Plan, including the risk factors and fees & charges, please refer to the offering documents of SunWish.

Investment involves risks and past performance is not indicative of future performance. Investment returns may rise as well as fall. Currency movements and market conditions may affect the value of investment.

Emerging markets may involve a higher degree of risk than in developed markets and are usually more sensitive to price movements. Prices of the underlying funds may have higher volatility due to investment in emerging markets, financial derivatives instruments or structured instruments, and may involve a greater degree of risk than the conventional securities.

This leaflet is intended to be distributed in Hong Kong only and shall not be construed as an offer to sell or a solicitation to buy or provision of any products of Sun Life Hong Kong Limited outside Hong Kong.

Offer 3: SunArchitect – Special Bonus Reward Offer

Important Notes

- SunArchitect (the “Plan”), being an investment-linked assurance scheme (“ILAS policy”), is an insurance policy issued by Sun Life Hong Kong Limited (“the Company”). Your investments are therefore subject to the credit risks of the Company. The premiums paid by you towards your ILAS policy will become part of the assets of the Company. You do not have any rights or ownership over any of those assets. Your recourse is against the Company only.

- Your return on investments is calculated or determined by the Company with reference to the performance of the underlying funds.

- The return of investments under your ILAS policy shall be subject to the charges of the scheme and may be lower than the return of the underlying funds.

- Early surrender or withdrawal of your ILAS policy/suspension of or reduction in contribution may result in a significant loss of principal and/or bonuses awarded. Poor performance of underlying funds may further magnify your investment losses, while all charges are still deductible.

- The investment-linked funds available under the scheme can have very different features and risk profiles. Some may be of high risk.

- Underlying funds available for selection are the funds listed in the Investment-Linked Fund Guide. These are funds authorized by the SFC pursuant to the Code on Unit Trusts and Mutual Funds.

- You should not purchase this product unless you understand it and it has been explained to you how it is suitable for you. The final decision is yours.

- The investment returns of the Plan may be subject to foreign exchange risks as some of the underlying funds may be denominated in a currency which is different from that of the Plan.

- The Plan does not have any guarantee of the repayment of principal. You may not get back the full amount of contribution you pay and may suffer investment losses.

- Investment involves risks. You should not rely on this material alone. Please read the offering documents of the Plan carefully including the Product Key Facts Statement and the Principal Brochure (which consists of the Product Brochure and the Investment-Linked Fund Guide). For more information about the underlying funds, please refer to the offering documents of the underlying funds which are made available by the Company upon request.

More importantly, you should be aware of the following regarding your death benefit and the cost of insurance (“insurance charges”):

- Part of the fees and charges you pay that will be deducted from the value of your ILAS policy will be used to cover the insurance charges for the life coverage.

- The insurance charges will reduce the amount that may be applied towards investment in the underlying funds selected. The insurance charges may increase significantly during the term of your ILAS policy due to factors such as the insured’s attained age and investment losses, etc. This may result in significant or even total loss of your contributions paid.

- If the value of your ILAS policy becomes insufficient to cover all the ongoing fees and charges, including the insurance charges, your ILAS policy may be terminated early and you could lose all your contributions paid and benefits.

- You should consult your intermediary for details, such as how the insurance charges may increase and could impact the value of your ILAS policy.

The Plan is a long-term investment-linked insurance plan combining life insurance coverage and investment opportunities. The following provides a highlight of certain key product features of SunArchitect only. For more details regarding the Plan and the respective investment-linked funds available under the Plan, please refer to the offering documents of the Plan. As investment involves risks, it is critical for you to understand the key product features and risks of the Plan.

There is a section “Glossary” at the end of this leaflet. For those words which are capitalized, unless stated otherwise, please refer to the section “Glossary” for explanation.

Key Product Features of SunArchitect

Minimum Contribution

- The Plan allows you to pay regular contribution over a Contribution Payment Term, ranging from 5 to 25 years, subject to the minimum Annualized Contribution Amount requirement. The minimum Annualized Contribution Amount requirement is USD2,400 per annum for Contribution Payment Term from 5 years to 14 years and USD1,200 per annum for Contribution Payment Term from 15 years to 25 years. Please refer to the section “Getting started” in the Principal Brochure – Product Brochure of the Plan for details.

Death Benefit

- The death benefit amount is equal to the higher of (i) 105% of your Policy Value or (ii) total amount of contributions that you have paid towards your ILAS policy less total amount of all partial withdrawals made by you. The death benefit will be paid to the beneficiary designated by you in the unfortunate event of the insured’s death.

- The death benefit stated above is subject to suicide clause. If the insured, whether sane or insane, commits suicide within 1 year after the policy start date (i.e. the date on which the policy becomes effective) or the reinstatement date, whichever is later, the death benefit will be equal to the Policy Value.

Please refer to the section “Life insurance protection for your loved ones” in the Principal Brochure - Product Brochure of the Plan for details.

Bonuses

- You may be entitled to a variety of bonuses including

i) First year bonus upon our confirmation of receipt of each payment of your regular contributions due and received during the first policy year. The first year bonus rate is up to 1.5% and it varies depending on your Annualized Contribution Amount (as at policy start date, i.e. the date on which the policy becomes effective);

ii) Long-term bonus up to 2.5% of the average Policy Value depending on your selected Contribution Payment Term and the payment ratio at the date when the relevant long-term bonus is payable, and

iii) Commitment bonus which is applicable to the ILAS policy with Contribution Payment Term of 15 years or more and is equal to 100% of the total amount of policy fee paid during the Contribution Payment Term. It is payable at the end of the Contribution Payment Term while the ILAS policy is still in effect.

The above bonuses are subject to the terms and conditions. Please refer to the section “Enjoy bonuses” in the Principal Brochure - Product Brochure of the Plan for details. The above bonuses will form part of the Policy Value and are subject to all applicable fees and charges as set out in the section “Schedule of Fees and Charges” in the Principal Brochure - Product Brochure of the Plan.

Partial Withdrawal

- After the completion of the Mandatory Contribution Period, you can make a one-off partial withdrawal from your Policy Value, free of charge, subject to its administrative rules as follows:

i) After the Mandatory Contribution Period but during the Surrender Charge Period - the minimum withdrawal amount is USD500 and the maximum withdrawal amount is up to an amount that the Policy Value immediately after the partial withdrawal is not less than the Annualized Contribution Amount (as at policy start date, i.e. the date on which the policy becomes effective) multiplied by the Mandatory Contribution Period (in policy months) divided by 12.

ii) After the Surrender Charge Period - the minimum withdrawal amount is USD500 and the maximum withdrawal amount is up to an amount that the Policy Value immediately after the partial withdrawal is not less than USD500.

- Partial withdrawal may lead to a significant reduction in the Policy Value, and accordingly the death benefit and any long-term bonus will be reduced. The reduction in the Policy Value may trigger policy termination if the Policy Value is insufficient to cover Monthly Deductions due. Please refer to the section “Access to your money” in the Principal Brochure - Product Brochure of the Plan for details.

Investment-Linked Funds

- The Company offers a range of investment-linked funds for you to choose from, each with different investment objectives, features and risk profile, so that you can choose the investment-linked fund mix that suits you the best.

Termination of Policy

- Policy will be automatically terminated under certain circumstances. Please refer to the section “Access to your money” in the Principal Brochure - Product Brochure of the Plan for details.

- Prior to the end of the Surrender Charge Period, there will be an early surrender charge in case of policy termination (other than as a result of the death of the insured) or surrender. Please refer to the section “Schedule of Fees and Charges” in the Principal Brochure - Product Brochure of the Plan for details.

Fees and Charges

- The Plan is subject to different fees and charges including the policy fee, administration charge, insurance charge, surrender charge, management charge and underlying fund charges. Please refer to the section “Schedule of Fees and Charges” in the Principal Brochure – Product Brochure of the Plan for details.

For more details regarding the Plan and the respective investment-linked funds available under the Plan, including fees and charges, please refer to the offering documents of the Plan. For more information about the underlying funds corresponding to the investment-linked funds available under the Plan, please refer to the offering documents of the underlying funds which are available from the Company upon request, free of charge.

Special Bonus Reward

From July 1, 2020 to September 30, 2020, both dates inclusive, customers who successfully apply for the Plan with Annualized Contribution Amount of USD1,200 or above (for Contribution Payment Term 15 years to 25 years) or Annualized Contribution Amount of USD2,400 or above (for Contribution Payment Term 5 years to 14 years), and the policies are issued on or before October 30, 2020 can enjoy the following bonus reward in the form of additional notional unit(s) of investment-linked fund(s) (“Special Bonus Reward”) under the Plan (subject to the Terms & Conditions set out below). The Special Bonus Reward will be calculated as follows:

Annualized Contribution Amount as at policy start date (i.e. the date on which the policy becomes effective) x Special Bonus Reward rate.

The Special Bonus Reward rate varies depending on your selected Contribution Payment Term and the Annualized Contribution Amount per policy as set out below:

Note: The above bonus rates do not represent the rate of investment return of your policy.

- A customer will not be entitled to the Special Bonus Reward if the policy(ies) is/are (i) cancelled within the cooling-off period or (ii) surrendered or terminated before the Special Bonus Reward is credited to the policy(ies).

- The Special Bonus Reward credited will not be clawed back if the policy(ies) is/are surrendered or terminated after the Special Bonus Reward(s) is/are credited to the policy(ies).

- The Special Bonus Reward will form part of Policy Value and is subject to all applicable fees and charges as described in the section “Schedule of Fees and Charges” in the Principal Brochure – Product Brochure of the Plan. Please refer to the section “Schedule of Fees and Charges” in the Principal Brochure – Product Brochure of the Plan for details.

Illustrative Example of Special Bonus Reward Calculation

The above examples are hypothetical and for illustrative purpose only.

For details, please contact your consultant.

Terms & Conditions:

(i) The Special Bonus Reward is only applicable to any new application(s) of the Plan submitted between July 1, 2020 to September 30, 2020, both dates inclusive (the “Promotion Period”).

(ii) A customer applying for more than one policy of the Plan within the Promotion Period shall not use the aggregate Annualized Contribution Amount of such policies in determining the Special Bonus Reward rate. The Special Bonus Reward is to be determined separately for each policy based on the respective Annualized Contribution Amount.

(iii) The Special Bonus Reward will be credited to customer’s policy(ies), for both annual and monthly payment modes, within December 2020 (the exact date will be determined by the Company) in the form of additional notional units of investment-linked fund(s) according to customers’ last executed investment-linked fund allocation instructions on condition that the policy(ies) is/are still in force at the time when Special Bonus Reward is credited.

(iv) The Special Bonus Reward is not transferable for cash.

(v) The amount of the Special Bonus Reward will be rounded to the nearest dollar.

(vi) A customer notification letter will be sent to a customer who is eligible for the Special Bonus Reward(s) within one month after the Special Bonus Reward(s) is/are credited to the policy(ies).

(vii) The above offer is subject to availability at the discretion of Sun Life Hong Kong Limited. Sun Life Hong Kong Limited reserves the right to vary, suspend or cancel the offer and amend the terms and conditions at any time without prior notice. If application of the Plan is submitted before variation, suspension or cancellation of the offer, customer will still be entitled to the offer prior to such changes. In the event of any dispute, the decision of Sun Life Hong Kong Limited will be final.

Glossary

- Annualized Contribution Amount refers to the regular contributions of the Plan that you wish to pay each year during the Contribution Payment Term.

- Contribution Payment Term means the period during which you choose to pay Annualized Contribution Amount towards your policy.

- Mandatory Contribution Period is an initial period, commencing on the policy start date (i.e. the date on which the policy becomes effective) and lasting for 15 to 36 policy months depending on the selected Contribution Payment Term, during which all due contributions are required to be paid.

- Monthly Deductions means the amount by which the Company will reduce the Policy Value on the first working day of each policy month. The Monthly Deductions include the policy fee, administration charge, and insurance charge of the death benefit.

- Policy Value is the sum of the value of notional units of all investment-linked funds held under your policy. The value of notional units of each investment-linked fund is the total number of notional units of such investment-linked fund multiplied by the bid price of the notional units of such investment-linked fund. Bid price means the price at which a notional unit of an investment-linked fund shall be redeemed.

- Surrender Charge Period is an initial period, commencing on the policy start date (i.e. the date on which the policy becomes effective) and lasting for 5 to 12 policy years depending on the selected Contribution Payment Term, during which a surrender charge is deducted from your Policy Value upon surrender or termination of the policy for any reason other than the death of the insured.

This leaflet contains general information only and shall not be construed as an offer to sell any policy(ies). For information of the Plan, including the risk factors and fees & charges, please refer to the offering documents of the Plan.

Investment involves risks and past performance is not indicative of future performance. Investment returns may rise as well as fall. Currency movements and market conditions may affect the value of investment.

This leaflet is intended to be distributed in Hong Kong only and shall not be construed as an offer to sell or a solicitation to buy or provision of any products of Sun Life Hong Kong Limited outside Hong Kong.

Not Going Out? Get Your Coverage Easily At Home

In view of the latest development of COVID-19, the Insurance Authority has rolled out phase 2 of Non-Face-To-Face (“NF2F”) Selling Process as a temporary facilitative measure* until 30 June 2020, to minimize the risk of infection from face-to-face meetings.

From now until 30 June 2020, clients only need to use a mobile phone or tablet to purchase insurance products via our brand-new “Digital Sales System” and pay the premium using a credit card. Upon approval of the application, clients can view and acknowledge receipt of the policy documents electronically in My Sun Life HK app. No face-to-face connection is required.

The following products are eligible for the NF2F selling process:

- Foresight Deferred Annuity Plan

- WeHealth

- WeHealth Plus (Scheme 1 & 2)

- Hospital Income Insurance Plan

- SunCare Accident Protection Plan

- SunHealth Medical Care

- SunHealth Medical Essential

- SunHealth Medical Premier

- One/Five Year Term Plan II

- Critical Medical Care Insurance Plan II

- SunHealth Cancer Shield

To learn more about the product details, please go to our company website or connect with your advisors.

*Note: Implementation details of the temporary facilitative measures include upfront disclosure at the point-of-sale and an extended cooling-off period from 21 calendar days to 30 calendar days.

Your Voice, We Heard

This March, we conducted a survey to collect your comments on our previous eNewsletters, as well as to find out areas which interest you the most in our quarterly eNewsletters. Out of the 633 responses we received, the following 3 areas are the most desired:

- Latest information and promotions (wealth and financial management tips, health and wellness information)

- Digital services (new functions in My Sun Life HK app and e-Services)

- Insurance products (product information and promotions for savings/medical insurance)

We would like to express our gratitude for your participation and valuable comments. Your comments will be used to help us to create and develop contents that fit you better. Trending topics and investment-related videos will be featured to provide you with a better reading experience.

4-Minute Lesson: Asset Management

Each month, our Chief Investment Strategist, Mr. JOHN LUI shares his investment knowledge and tips, global economy trends and market overview in the 4-minute “Macro Observation” video.

You can view “Sun Life Asset Management - Macro Observation” videos HERE* and revisit the April and May editions (in Cantonese, with Chinese and English subtitles). Besides, you can access more market views and investment-related news on the Asset Management page on our company website, including quarterly Market Navigator and MPF Average Disparity Index. Editorial columns will be updated monthly for you to better understand the investment world.

*Note: All videos and article content are issued by Sun Life Asset Management (HK) Limited. They are only for general information sharing and do not constitute any investment opinion. This is neither an invitation of investment nor agreement to make any product purchase.

Live Healthily & Fight Diabetes

Our Facebook Group, “Siu Tong Café” (糖不得冰室), which is part of the pre-diabetes control management programme (掌糖人計劃) was recently launched! Featuring “The Tong’s family”, the group aims to provide health tips and knowledge regarding diabetes, including exercise, diet, habits and related medical cost information, to raise the awareness of the disease.

On the move with Glucolife

The Glucolife app assists you to live a healthier life by monitoring your daily exercising, dieting and resting.

- Professional – Calculates your health risk: Aktivo Score® and Fibre Score are developed by a team of professionals in medical field and artificial intelligence (AI) based on scientific studies.

- Thoughtful - Improve your health life: Giving practicable suggestions on exercising, dieting and resting, as well as recipes with highly-fibred ingredients. This leads you to acquire better habits and thus, a healthier life.

- Engaging - Motivates you to complete health challenges: A series of health challenges are there to motivate you to keep moving. You may even get your lifestyle rewards after completing the challenges.

Join our Siu Tong Café and live a healthy life with us!

Download Glucolife app and use registration code “slf-news2020” to log in.

Note:

- The information is provided to you by third-party service provider Aktivolabs Pte. Ltd. (“Aktivo”) via its mobile app Glucolife (“Glucolife”). You may download Glucolife on Apple Store and Google Play. By downloading or using Glucolife, you may be bound the relevant terms and conditions. Sun Life may promote or quote information from Glucolife. The promotion or quotation of any such information shall not constitute any form of warranty, guaranty, or representation on the accuracy, validity or completeness of such information, whether expressly or impliedly, by Sun Life. Sun Life is not responsible for any loss or damage whatsoever arising out of or in connection with any such information.

- Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

- Google Play and the Google Play logo are trademarks of Google LLC.

Health Info: Pneumonia

The outbreak of COVID-19 is undeniably the hottest topic over the last few months, raising public awareness on hygiene and prevention of infection. Indeed, before COVID-19, Pneumonia has been one of the leading causes of death in Hong Kong. In 2019, over 9,000 lives were taken due to pneumonia*.

Causes

Pneumonia is a common lower respiratory tract disease, referring to an infection of the lungs caused by bacteria, viruses, or fungi. Inflamed cells interrupt the exchange of oxygen in bloodstream, causing difficulties in breathing. A cold or influenza are found to be a common cause of pneumonia as they affect the immune system. Regardless of age, anyone can get pneumonia. Elderly, infants and people with chronic diseases are at higher risk. Regular smokers and even second-hand smokers at young age are also more prone to be infected.

Symptoms

The symptoms of pneumonia are often mistaken with influenza at first. The critical period for cure is always hindered as a result. Symptoms include:

- Cough with greenish, yellow or bloody mucus

- Fever, sweating or shaking chills

- Difficulty in breathing, or short, rapid and shallow breathing

- Chest pain when breathing or coughing

- Loss of appetite, low energy and fatigue

- Nausea and vomiting

- Confusion

Prevention

Public awareness to prevent diseases has been raised recently. To fight pneumonia, everyone has to wash your hands frequently, wear a mask when you are sick or at hospitals or clinics, and drink adequate amount of water to keep your throat moist. The following steps could also help to reduce your risk of infection:

- Get pneumococcal and influenza vaccination regularly: a cold or influenza may induce pneumonia. Getting vaccinated is one of the most effective measures in prevention.

- Quit smoking and drinking

- Maintain a balanced diet and consume supplements as advised by professionals

- Avoid going to crowded or poorly ventilated places

- Use serving utensils for group meals to prevent exchange of viruses in our saliva

- Avoid indoor air pollution (due to combustion of wood and such)

- Practice breastfeeding: breastfeeding infants in the first 6 months after being born can help boost the immune system. Period of illness can also be shortened.

Source: Centre for Health Protection of Department of Health* , World Health Organization, American Lung Association.

Special Arrangements for the Novel Coronavirus Infection

In view of the Novel Coronavirus Infection (“COVID-19”, according to World Health Organization) situation, Sun Life Hong Kong launched several special handling arrangements, effective from 24 January until 30 April 2020, to make it easier for our clients.

Measures include policy coverage arrangement and claims procedure handling stated as below:

Policy Coverage Arrangement

- Waive waiting period (applicable to all individual medical policies)

- Relax 3A hospital restriction in Mainland China and accept treatments provided by non-3A hospitals in Mainland China

- Allow reinstatement without underwriting on lapsed policy if premium payment is delayed due to treatment 1

Claims Procedure Handling

- Claims decision will be made within 1 working day (applicable to all individual medical policies)

- Special and expedited handling for COVID-19 cases through Client hotline: 2103 8928

- Simplified applications by only showing the diagnosis proof, no claim forms required

- Easy submission via My Sun Life HK app anytime, anywhere

- Rapid payment by Faster Payment System (FPS) to client’s local bank account 2

Remarks:

1. The client needs to provide the diagnosis proof within 30 days after discharge.

2. Only applicable to clients registered with a FPS account and must be registered under the policy owner.

Additional arrangements:

1. No Claim Discount

No claim discount will be applied to clients have individual medical benefit1, who admit to a hospital due to diagnosed with “COVID-19”, with effective period from 24 January to 30 April 2020 (both dates inclusive).

2. Waive Standalone Medical Plan’s Examination and Lab Test Fee

For new applications for standalone medical benefit2 during the designated application submission period (from 24 January 2020 to 30 April 2020; both dates inclusive), the medical cost for examination / test / Attending Physician’s report during medical underwriting will be borne by Sun Life only during this period.

Remarks:

1. Applicable to SunHealth Medical Care, SunHealth Medical Fit and WeHealth Plus (Scheme 1 and 2)

2. Applicable to SunHealth Medical Care (Basic Plan), WeHealth, WeHealth Plus (Scheme 1 and 2), SunHealth Medical Essential (Basic Plan) and SunHealth Medical Premier (Basic Scheme)

Frequently Asked Questions:

Special Arrangements on “Severe Respiratory Disease associated with a Novel Infectious Agent” (“COVID-19”, according to World Health Organization)

Valid period: From 24 January 2020 to 30 April 2020 (both dates inclusive)

Medical Policy

Q1. I am a Sun Life individual medical policy owner. I got admitted to a hospital and was diagnosed with “COVID-19”. Will the contract terms of waiting period apply?

A1. No, the special arrangements during the valid period apply to ALL individual medical policies. If you are admitted to a hospital due to confirmed “COVID-19”, within the effective period of 24 January to 30 April 2020 (both dates inclusive), the waiting period would be waived.

Q2. If I got admitted to the isolation ward in a hospital due to confirmed “COVID-19”, is medical benefit covered?

A2. Yes, it is covered (applicable to all individual medical policies).

Q3. If I got admitted to a hospital in Mainland China due to confirmed “COVID-19”, is medical benefit covered?

A3. Yes, when you are admitted to a hospital during the special arrangements valid period (24 January to 30 April 2020), we cover treatments provided by all hospitals including non-3A hospitals in Mainland China (applicable to all individual medical policies).

Claim

Q4. If I got admitted to a hospital due to confirmed “COVID-19”, is the original hospital receipt required when I submit a claim request?

A4. No. We understand this is a difficult time and in order to simplify the claim process, a claim form is not required. We will accept a copy of the diagnosis proof and hospital receipt – originals are not required.

Q5. How can I submit a claim without needing to come to your offices?

A5. My Sun Life HK app allows you to submit medical and personal accident claims anytime, anywhere and is the fastest channel. Alternatively, you may also mail documents to our office at:

Sun Life Hong Kong Limited

G/F, Cheung Kei Center Tower B,

18 Hung Luen Road,

Hunghom, Kowloon,

Hong Kong

Q6. Is there any claim payment methods other than cheques?

A6. Yes, rapid payment by Faster Payment System (FPS) by direct payment to client’s local bank account is available. It is only applicable to clients registered with a FPS account and must also be registered under the policy owner.

Q7. After the claim submission, when will I get the claim result?

A7. We will provide the claim decision in 1 working day (applicable to all individual medical policies). You can find the status of your claim in our My Sun Life HK app.

Q8. Will being treated and claiming for the “COVID-19” affect the “No Claim Discount” benefit in my policies1?

A8. No. Our “No Claim Discount” will still be enjoyed by our clients even though clients had to be admitted to a hospital due to confirmed “COVID-19” during the period from 24 January to 30 April 2020 (both dates inclusive).

Critical Illness Benefit

Q9. Is “COVID-19” under our Critical Illness coverage?

A9. No, it is not under the listed Critical Illnesses in our Critical Illness benefit. However, if the “COVID-19” turns into any covered Critical Illnesses (for example, End Stage Lung Disease under SunHealth OmniCare benefit), and if the symptoms surpassed waiting period and the conditions fulfilled the Critical Illness contract definition, the Critical Illness claim will be paid.

Accident Benefit

Q10. Is “COVID-19” under our accident coverage?

A10. No, “COVID-19” is not covered in our accident plans.

Reinstatement

Q11. If I am diagnosed with “COVID-19”, and couldn’t pay my premium on time causing it to lapse, would policy reinstatement be allowed?

A11. Yes, you can submit a request with diagnosis proof within 30 days from the hospital discharge date. No underwriting is required.

New Business

Q12. I am interested in medical insurance and would like to apply for standalone medical benefit2. If Sun Life wants me to attend a medical examination, do I have to bear the cost?

A12. No, if a new application for standalone medical benefit2 is submitted during the period of 24 January to 30 April 2020 (both dates inclusive), any costs for medical examination/laboratory test/attending physician’s report during medical underwriting will be borne by Sun Life only during this period.

Policy Administration

Q13. Is there any way I can find out more about my policy details and make transaction requests other than having to mail in forms/requests or come into your Service Centre?

A13. Yes, My Sun Life HK app allows you to access your policies anytime, anywhere.

You are able to view your:

- Policies and coverage for your whole family

- Total policy assets including savings and funds balances

- Details of your medical and surgical coverages/benefits

- Policy anniversary statements

- Policy contracts (for policies issued on or after 1 April, 2019 and you are an individual client, NOT a corporate client)

- And much more

You are able to receive:

- Policy acknowledgement receipts

- Notifications on when premiums are due

- Notifications on the status of your requested transactions

You are able to:

- Submit hospital and accident claims

- Update your personal information (e.g. address, number and other contact details)

- Change premium allocations

- Switch funds

- Setup a standing instruction (Withdraw dividend and/or coupon fund from a policy pay to itself / another policy’s premium & levy on premium due date)

Dedicated Hotline

Q14. In case I have further enquiries related to “COVID-19”, is there any dedicated person or hotline that I can reach out to?

A14. Yes, you may call our dedicated hotline at (852) 2103-8928.

Remarks:

1. Applicable to SunHealth Medical Care, SunHealth Medical Fit and WeHealth Plus (Scheme 1 and 2).

2. Applicable to SunHealth Medical Care (Basic Plan), WeHealth, WeHealth Plus (Scheme 1 and 2), SunHealth Medical Essential (Basic Plan) and SunHealth Medical Premier (Basic Scheme).

We will monitor the situation and update with any further arrangements and announce accordingly. Sun Life reserves the rights to vary, suspend or cancel the above arrangements and amend the terms and conditions at any time without prior notice. In the event of any disputes, the decision of Sun Life will be final and conclusive.

For more details, please visit our company website on Sun Life offers special supportive arrangements on “COVID-19” or seek assistance from your agent.

Better Services with Our New Office