The happiness of your loved ones is what matters most in life. That’s why building a financially secure future is so important.

- Please enter a search term.

-

China

Hong Kong, SAR

Indonesia

International

Ireland

Malaysia

Singapore

United Kingdom

Vietnam

Worldwide (sunlife.com)

- Please enter a search term.

-

Value-added services

-

Overview

-

Medical Concierge Services

-

Local Urgent Care

-

AdvicePro (Face-to-face Second Medical Opinion Services)

-

Cashless Arrangement Service

-

Mainland China VIP Medical Navigation Service

-

Comprehensive Genomic Profiling

-

Family Care Benefit

-

Cancer and Stroke Family Support Program

-

Worldwide Emergency Assistance Benefits

-

Critical Illness Professional Assessment and Referral

-

Overseas Medical Referral and Arrangement Service

-

Overview

-

Medical Concierge Services

-

Local Urgent Care

-

AdvicePro (Face-to-face Second Medical Opinion Services)

-

Cashless Arrangement Service

-

Mainland China VIP Medical Navigation Service

-

Comprehensive Genomic Profiling

-

Family Care Benefit

-

Cancer and Stroke Family Support Program

-

Worldwide Emergency Assistance Benefits

-

Critical Illness Professional Assessment and Referral

-

Overseas Medical Referral and Arrangement Service

Savings & life

-

Overview

-

Fulfillment ratios of respective products

-

Dividend and bonus philosophy of respective products

-

FlexiRetire Annuity Plan

-

Foresight Deferred Annuity Plan

-

Generations II

-

LIFE Brilliance

-

One / Five Year Term Plan II

-

Stellar Multi-currency Plan

-

SunGift

-

SunGift Global

-

SunGuardian / SunGuardian (Care Version)

-

SunJoy

-

SunJoy Global

-

SunProtect

-

Venus II

-

Victory

-

Vision

-

Overview

-

Fulfillment ratios of respective products

-

Dividend and bonus philosophy of respective products

-

FlexiRetire Annuity Plan

-

Foresight Deferred Annuity Plan

-

Generations II

-

LIFE Brilliance

-

One / Five Year Term Plan II

-

Stellar Multi-currency Plan

-

SunGift

-

SunGift Global

-

SunGuardian / SunGuardian (Care Version)

-

SunJoy

-

SunJoy Global

-

SunProtect

-

Venus II

-

Victory

-

Vision

Voluntary health insurance scheme (VHIS)

Medical & critical illnesses

Accident & disability

Universal life

MPF scheme

-

Overview

-

Sun Life Rainbow MPF Scheme

-

Digitalizing your MPF journey

-

MPF FAQs (For Sun Life Rainbow MPF Scheme only)

-

Tax Deductible Voluntary Contributions (TVC)

-

Personal Account

-

Default Investment Strategy (DIS)

-

Visit Key Scheme Information Document (Web version)

-

Employee choice arrangement

-

About the eMPF Platform

-

Hotline & address

-

Overview

-

Sun Life Rainbow MPF Scheme

-

Digitalizing your MPF journey

-

MPF FAQs (For Sun Life Rainbow MPF Scheme only)

-

Tax Deductible Voluntary Contributions (TVC)

-

Personal Account

-

Default Investment Strategy (DIS)

-

Visit Key Scheme Information Document (Web version)

-

Employee choice arrangement

-

About the eMPF Platform

-

Hotline & address

ORSO fund prices & performance

Quick links

Quick links

Who we are

Corporate responsibility

Become an employee

Tools & resources

-

Overview

-

Digital insurance experience

-

WeChat

-

My Sun Life HK Client Digital Platforms

-

Retirement Calculator

-

My Sun Life HK – Group Health app

-

Education Budget Calculator

-

Bright Solutions

-

Cost estimator of treating major illnesses

-

First Contribution Calculator

-

Investment Risk Assessment

-

Retirement Savings Calculator

-

Expense Calculator

-

Savings Planning Calculator

-

Overview

-

Digital insurance experience

-

WeChat

-

My Sun Life HK Client Digital Platforms

-

Retirement Calculator

-

My Sun Life HK – Group Health app

-

Education Budget Calculator

-

Bright Solutions

-

Cost estimator of treating major illnesses

-

First Contribution Calculator

-

Investment Risk Assessment

-

Retirement Savings Calculator

-

Expense Calculator

-

Savings Planning Calculator

[Semi-Private room medical coverage in Asia] Apply WeHealth Prestige to get 6 months premium rebate! Click here

Nurture a healthier tomorrow

SunWell Advanced Care and SunWell Supreme Care

Enjoy up to 5-month premium rebate of AFYP upon successful application

Save for the future

SunJoy Global

Enjoy up to 65% of AFYP upon successful application

Terms and conditions apply.

Plan for your loved ones

SunGift Global

Enjoy up to 65% premium rebate of AFYP upon successful application

Terms and conditions apply.

Important note

Beware of scams! Do not provide bank, credit card, investment, insurance and MPF account or other key personal information via hyperlinks embedded in suspicious messages purported to be coming from our institution! If you have any concerns or questions, please contact the Sun Life Client service hotline at (852) 2103 8928

Embrace our environment with the eAdvice service

No more paper, no more hassle! We have replaced mailing of printed letters with eAdvice to make our #OnlyOneEarth greener.

Shine together

We are hiring corporate positions. Unleash your potential to help our clients live healthier lives!

Start your retirement plan early

Have you considered compound interest and its rolling effect on your long-term savings?

Online Tool

Take a few minutes to estimate your financial need.

Get your medical quote now!

Find out how much suits best to your medical protection.

Savings & life

Medical & critical illness

Start preparing to fund your medical expenses, and protect yourself against high medical costs and daily expenses should you become sick.

Universal life

Are you looking for a plan that will protect and grow your savings simultaneously?

Brighter in every life moment

You surely want to step into each life moment with comfort, as you plan. The right financial planning will help take you to reach your goals from staying healthy, parenting and preparing to retire for brighter life

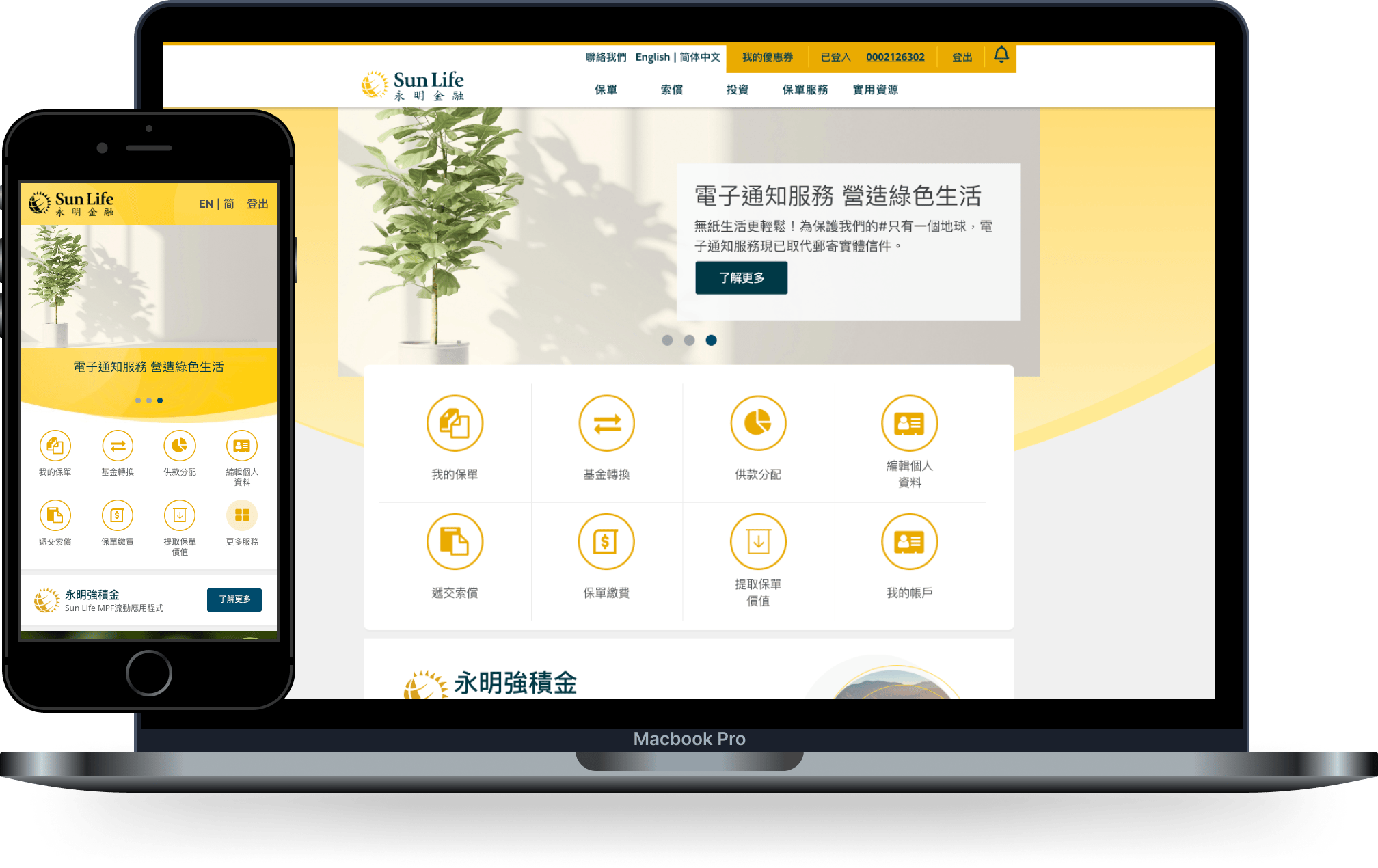

My Sun Life HK Client Digital Platforms

Bright features of My Sun Life HK

Learn more

Make a Claim

Submit Accident or Hospitalization & Surgical claims in one go and stay tuned with the status.

Update Your Personal Information

No forms or signatures required. Keep your correspondence address, contact number and email address up-to-date.

Access Your Documents Anytime

Sign up for eAdvice service to view all your policy documents and coverage details whenever you need to.

Why choose Sun Life?

Our 130 years of experience has helped us to understand you better

Achievements

Over the years, our many awards for both products and performance have told the world about our quality.

Corporate responsibility

Our focus on sustainability helps us bring our company purpose to life, and is central to our business strategy.

Innovation

With our philosophy of creating "Clients for Life", we strive to develop innovate products and services that our Clients trust.