“Saving for children before they are born”: the ultimate way to win at the starting line?

When talking about children “winning at the starting line”, what do you think of? Monster parents? Helicopter parents? Tiger mums and dads? But, in fact, many young actually become “slaves to their children”, and bear enormous financial burdens for their kids. According to a recent survey, up to 59% of parent respondents aged 34 or below (i.e. the 80s and 90s generations) had already started saving money for their children before they were even born: just to help them get a head start on their future.

Young parents saved over $500,000 for their kids

From April 12 to May 6, 2018, Sun Life Hong Kong conducted a major child-rearing study in Hong Kong. Conducted via online questionnaires and face-to-face interviews, the survey entitled “Should Parents Realize their Children’s Wishes?” sought the views of 690 parents and 141 students on financial management related to child-rearing.

The results showed that up to 59% of parent respondents aged 34 or below (i.e. the 80s and 90s generations) had already started saving money for their children’s future before their children were actually born. They have saved an average of HK$558,844 per child, equivalent to almost 20 months of the median monthly household income in Hong Kong1. In general, 46% of parent respondents agreed that parents should start saving before the birth of their children. What is interesting, however, is that 62% of student respondents believed that their parents should support their children at least until the completion of their studies.

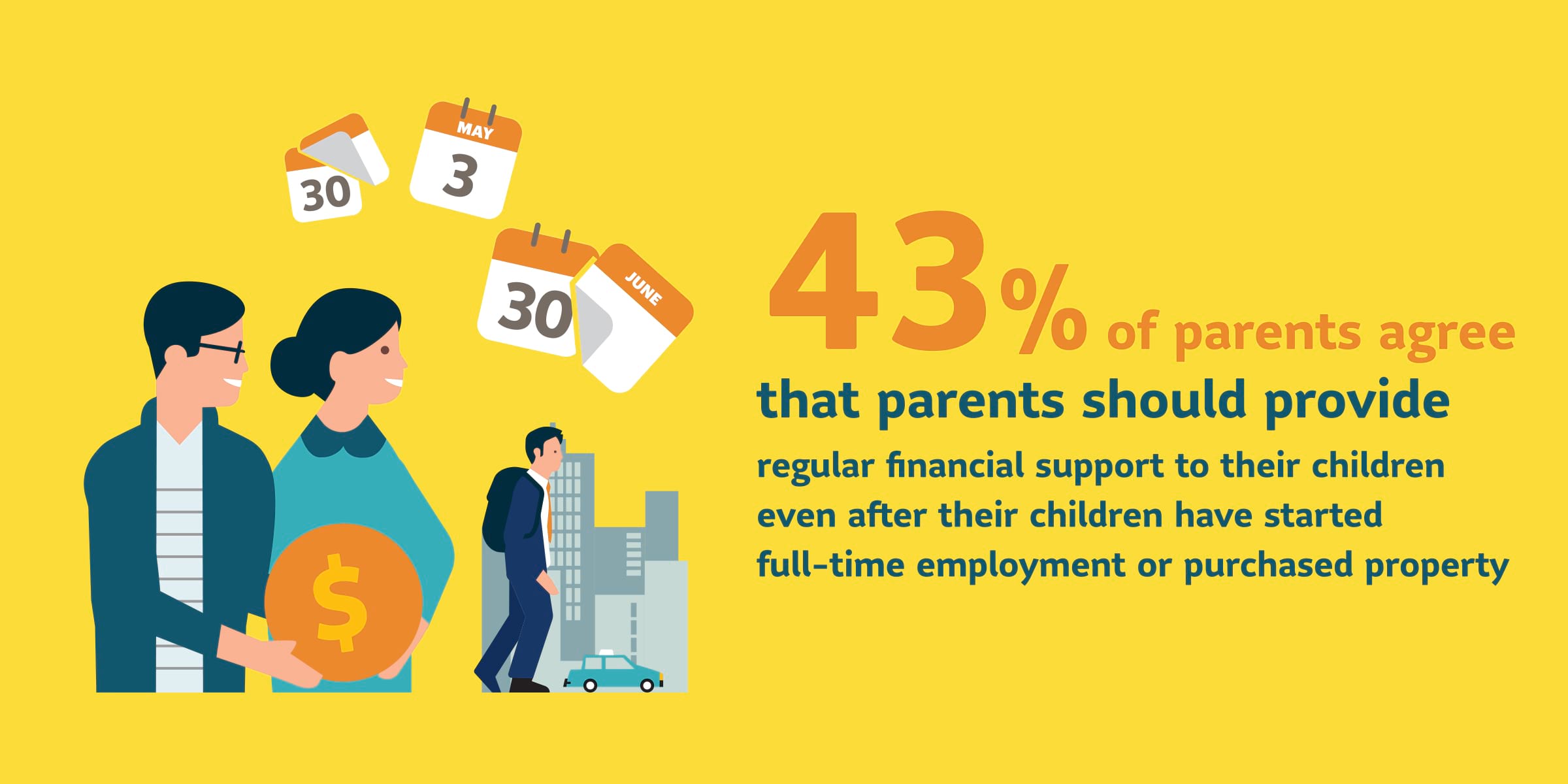

Parents’ endurance test, running to a more distant finishing line

Not only are parents starting to save earlier, many are planning to take on an excruciating financial endurance test for their kids. 43% of parent respondents agreed that parents should continue to provide regular financial support for children for the first year after their children had started full-time employment, or even to the third year, or even further until their kids had purchased property.

About one-third of the student respondents agreed that parents should support their children financially even after they had completed their studies. They thought that the actual monthly amount should be around HKD$6,000 ($5,991).

Striving to save, but without a Plan B

In terms of how to save, the most popular methods that parents said they chose were HKD or foreign currency saving accounts, time deposits, insurance-based savings or investment products2 , even investing in relatively high-risk stocks. However, when asked what if the family member contributing the major share to their children’s savings failed to continue his or her contributions for some reason, 85% of respondents thought that would affect their children to different degrees.

But 55% of them said they had no backup plan to sustain their savings for their children’s future. And among these, 46% thought it was hard to prepare for this kind of situation. 29% had no idea of any alternative solutions, and the rest either had never thought of it, or just thought they simply didn’t need a plan B.

However, if parents want to maintain long-term commitments for their children, in addition to trying hard to save, they should also evaluate their means of saving. When facing a future with lots of unpredictable changes, even if parents are fully prepared financially, if they neglect to make contingency plans, or a plan B, they might not be able to truly protect their children’s benefits after all.

If you want to make a lifetime commitment to your children come rain or shine, get to know more about our new product Commitment.

1 According to the Quarterly Report on General Household Survey (2018) conducted by the Census and Statistics Department, the median monthly household income during January to March (Q1) in Hong Kong was HKD$28,100.

2 Insurance products that Include insurance-based saving and investment