Note: The exact proportion of the portfolio in higher/lower risk assets at any point in time may deviate from the target glide path due to market fluctuations.

- Please enter a search term.

-

China

Hong Kong, SAR

Indonesia

International

Ireland

Malaysia

Singapore

United Kingdom

Vietnam

Worldwide (sunlife.com)

- Please enter a search term.

-

Value-added services

-

Overview

-

Medical Concierge Services

-

Local Urgent Care

-

AdvicePro (Face-to-face Second Medical Opinion Services)

-

Cashless Arrangement Service

-

Mainland China VIP Medical Navigation Service

-

Comprehensive Genomic Profiling

-

Family Care Benefit

-

Cancer and Stroke Family Support Program

-

Worldwide Emergency Assistance Benefits

-

Critical Illness Professional Assessment and Referral

-

Overseas Medical Referral and Arrangement Service

-

Overview

-

Medical Concierge Services

-

Local Urgent Care

-

AdvicePro (Face-to-face Second Medical Opinion Services)

-

Cashless Arrangement Service

-

Mainland China VIP Medical Navigation Service

-

Comprehensive Genomic Profiling

-

Family Care Benefit

-

Cancer and Stroke Family Support Program

-

Worldwide Emergency Assistance Benefits

-

Critical Illness Professional Assessment and Referral

-

Overseas Medical Referral and Arrangement Service

Savings & life

-

Overview

-

Fulfillment ratios of respective products

-

Dividend and bonus philosophy of respective products

-

FlexiRetire Annuity Plan

-

Foresight Deferred Annuity Plan

-

Generations II

-

LIFE Brilliance

-

One / Five Year Term Plan II

-

Stellar Multi-currency Plan

-

SunGift

-

SunGift Global

-

SunGuardian / SunGuardian (Care Version)

-

SunJoy

-

SunJoy Global

-

SunProtect

-

Venus II

-

Victory

-

Vision

-

Overview

-

Fulfillment ratios of respective products

-

Dividend and bonus philosophy of respective products

-

FlexiRetire Annuity Plan

-

Foresight Deferred Annuity Plan

-

Generations II

-

LIFE Brilliance

-

One / Five Year Term Plan II

-

Stellar Multi-currency Plan

-

SunGift

-

SunGift Global

-

SunGuardian / SunGuardian (Care Version)

-

SunJoy

-

SunJoy Global

-

SunProtect

-

Venus II

-

Victory

-

Vision

Voluntary health insurance scheme (VHIS)

Medical & critical illnesses

Accident & disability

Universal life

MPF scheme

-

Overview

-

Sun Life Rainbow MPF Scheme

-

Digitalizing your MPF journey

-

MPF FAQs (For Sun Life Rainbow MPF Scheme only)

-

Tax Deductible Voluntary Contributions (TVC)

-

Personal Account

-

Default Investment Strategy (DIS)

-

Visit Key Scheme Information Document (Web version)

-

Employee choice arrangement

-

About the eMPF Platform

-

Hotline & address

-

Overview

-

Sun Life Rainbow MPF Scheme

-

Digitalizing your MPF journey

-

MPF FAQs (For Sun Life Rainbow MPF Scheme only)

-

Tax Deductible Voluntary Contributions (TVC)

-

Personal Account

-

Default Investment Strategy (DIS)

-

Visit Key Scheme Information Document (Web version)

-

Employee choice arrangement

-

About the eMPF Platform

-

Hotline & address

ORSO fund prices & performance

Quick links

Quick links

Who we are

Corporate responsibility

Become an employee

Tools & resources

-

Overview

-

Digital insurance experience

-

WeChat

-

My Sun Life HK Client Digital Platforms

-

Retirement Calculator

-

My Sun Life HK – Group Health app

-

Education Budget Calculator

-

Bright Solutions

-

Cost estimator of treating major illnesses

-

First Contribution Calculator

-

Investment Risk Assessment

-

Retirement Savings Calculator

-

Expense Calculator

-

Savings Planning Calculator

-

Overview

-

Digital insurance experience

-

WeChat

-

My Sun Life HK Client Digital Platforms

-

Retirement Calculator

-

My Sun Life HK – Group Health app

-

Education Budget Calculator

-

Bright Solutions

-

Cost estimator of treating major illnesses

-

First Contribution Calculator

-

Investment Risk Assessment

-

Retirement Savings Calculator

-

Expense Calculator

-

Savings Planning Calculator

[Semi-Private room medical coverage in Asia] Apply WeHealth Prestige to get 6 months premium rebate! Click here

Default Investment Strategy (DIS)

is a ready-made investment arrangement as stipulated in accordance with the Mandatory Provident Fund Schemes Ordinance mainly designed for those members who are not interested or do not wish to make a fund selection, and is also available as an investment choice itself for members who find it suitable for their own circumstances.

Important Note

- Sun Life Rainbow MPF Scheme (the "Scheme") is a mandatory provident fund scheme.

- Investment involves risks and not all investment choices available under the Scheme would be suitable for everyone. There is no assurance on investment returns and your investments/accrued benefits may suffer significant loss.

- You should consider your own risk tolerance level and financial circumstances before making any investment choices. When, in your selection of funds, you are in doubt as to whether a certain fund is suitable for you (including whether it is consistent with your investment objectives), you should seek financial and/or professional advice and choose the fund(s) most suitable for you taking into account your circumstances.

- Members reaching 65th birthday or early retiring on reaching age 60 may apply (in such form and on such conditions as the Trustee may from time to time determine but subject to the Mandatory Provident Fund Schemes Ordinance and Regulation) for payment of the MPF Benefits in instalments. Please refer to section 6.1.12 “Withdrawal of Benefits of the MPF Scheme Brochure of the Scheme for further details.

- You should not invest based on this material alone and you should read the MPF Scheme Brochure carefully for further details including risk factors.

A. Default Investment Strategy ("DIS") Basic features

1. What is DIS?

- DIS is a ready-made investment arrangement as stipulated in accordance with the Mandatory Provident Fund Schemes Ordinance mainly designed for those members who are not interested or do not wish to make a fund selection, and is also available as an investment choice itself for members who find it suitable for their own circumstances.

- The DIS is not a fund - it is a strategy that uses two constituent funds ("CFs"), namely the Core Accumulation Fund ("CAF") and the Age 65 Plus Fund ("A65F") (collectively the "DIS CFs") to automatically reduce members' risk exposure as members approach their retirement age through investing in the DIS CFs according to the pre-set allocation percentages specified by law.

- The DIS is required by law, with effect from 1 April 2017, to be offered in every MPF scheme and is designed to be substantially similar in all MPF schemes. However, members should note that DIS does not guarantee capital repayment or positive investment returns and, therefore, members may suffer losses from the investments into DIS.

2. What are its features?

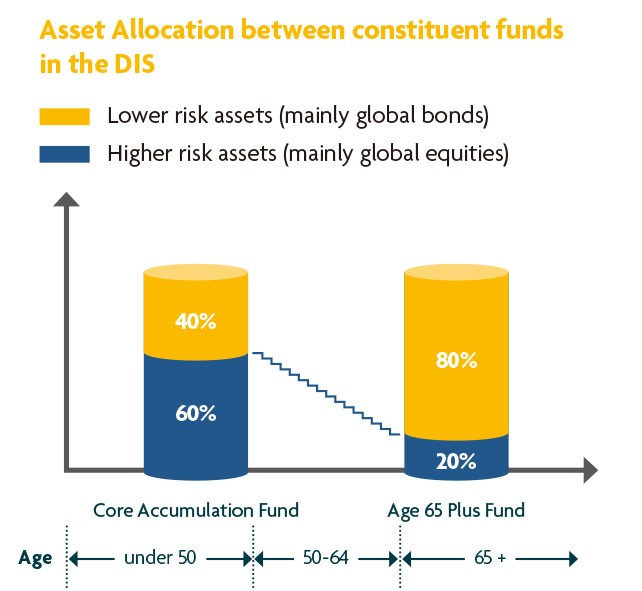

- Asset Allocation of the DIS

- The DIS aims to balance the long term effects of risk and return through investing in two CFs, namely the CAF and A65F, according to the pre-set allocation percentages at different ages.

- The CAF will invest around 60% in higher risk assets (higher risk assets generally mean equities or similar investments) and 40% in lower risk assets (lower risk assets generally mean bonds or similar investments) of its net asset value.

- The A65F will invest around 20% in higher risk assets and 80% in lower risk assets.

- DIS CFs adopt globally diversified investment principles and use different classes of assets, including global equities, fixed income, money market and cash, and other types of assets allowed under the MPF legislation.

- Automatic De-risking

- The DIS will manage investment risk exposure by automatically reducing the exposure to higher risk assets and correspondingly increasing the exposure to lower risk assets as the member gets older.

- The de-risking is to be achieved by way of reducing the holding in CAF and increasing the holding in A65F throughout the prescribed time span as detailed below.

- Before a member reaches the age of 50, all accrued benefits as well as future contributions and accrued benefits transferred from another registered scheme ("Future Investments") will be invested into the CAF. After a member reaches age 50, the trustee will start automatically moving some investment (around 6.7% of assets) from CAF to A65F every year. This process will continue until the member reaches age 65 when all assets will be held in A65F.

Note: The above allocation between the CAF and A65F is made at the point of annual de-risking and the proportion of the CAF and A65F in the DIS portfolio may vary during the year due to market fluctuations.

- Statutory Fee Control

For the 2 CFs in the DIS, the law imposes the following ceilings on the fees and out-of-pocket expenses:

- The aggregate of the payments for services of the CAF and A65F must not, in a single day, exceed a daily rate of 0.75% per annum of the net asset value of each of the DIS CFs divided by the number of days in the year (including, but not limited to, fees paid or payable for service of trustee, custodian, administrator, investment fund manager, sponsor and the underlying investment fund(s) of the respective DIS CFs, etc. but exclude any out-of-pocket expenses incurred by each DIS CFs and its underlying investment fund(s)).

- The amount of out-of-pocket expenses incurred by the trustee on a recurrent basis in the discharge of the trustee's duties to provide services in relation to the DIS CFs shall not in a single year exceed 0.2% of the net asset value of the DIS CFs.

B. Impact of the new default investment logic on affected member after 1 April 2017

- For member's existing account with valid investment instruction for the accrued benefits and Future Investments provided by the member or the member reaches age 60 before 1 April 2017, you will not be affected by the implementation of the DIS.

- For members who is under or becoming age 60 on 1 April 2017, you are affected in the following ways:

- For a new member joining a scheme, if the member does not make an investment choice, all accrued benefits and Future Investments will be automatically invested through the DIS. The member can also actively choose the DIS as the preferred investment choice.

- For existing member's account which is fully invested in the existing default fund and the member has never given investment instructions, the trustee will send a notice, namely DIS Re-investment Notice to the member within the first 6 months of implementation. If the member does not respond, then the member's accrued benefits in the existing default fund will be redeemed in whole and re-invested in accordance with the DIS.

- For existing member's account with part of accrued benefits invested in the existing default fund and the member has never given investment instruction, the trustee will invest the accrued benefits in the same manner as accrued benefits were invested immediately before 1 April 2017. Future Investments will be invested in the DIS or in accordance with the member's investment mandate, where applicable and appropriate.

- For existing member's account with no investment mandate provided by member but with accrued benefits transferred from another account within the Scheme (including automatic transfer of accrued benefits from contribution account to personal account after cessation of employment, the member's accrued benefits will be invested in the same manner as accrued benefits were invested immediately before 1 April 2017. Future Investments will be invested in the DIS. In the event that the existing member's account utilizing Fund Cruiser, the member will be deemed to have exited the Fund Cruiser, to the extent that the automatic fund allocation programme according to the Asset Allocation Table under section 6.1.10(a) will be ceased on April 1, 2017.

- For members with existing MPF, they can actively choose to invest through the DIS by submitting a fund switching request to their trustees. As in other CFs, members can also switch out of the DIS at any time as permitted by scheme rules.

C. Dealing day of annual de-risking

The de-risking is achieved by annual adjustment of asset allocation gradually from CAF to A65F under the DIS when the member reaches age 50. Switching of the existing accrued benefits among CAF and A65F will generally be automatically carried out each year on a member's birthday according to the allocation percentages in the DIS De-risking Table as shown above. If a member's birthday is not a dealing day, then the investments will be moved on the next available dealing day. Moreover, if at the time of annual de-risking, there is one or more of the specified instructions (including but not limited to subscription and redemption, for example, transfer instructions, withdrawal instructions, instructions for refund or payment of any statutory long service / severance pay, change of investment mandate instruction or switching instructions) are being processed for a relevant member, the annual de-risking will only take place after completion of these instructions where necessary.

D. Communication of DIS-related information

The DIS Pre-Implementation Notice ("DPN") was sent to all members by January 2017.

To download the DPN, please click here.

To download the MPF Scheme Brochure of the Scheme, please click here.

The DIS Re-Investment Notice ("DRN") would be sent to the relevant members whose accrued benefits would subject to be re-invested according to DIS within April starting from April 11, 2017.

There is a reply form (“Option 2 Form”) attached to the DRN. Members are required to complete and send this Option 2 Form to us within 42 days after the date of the DRN (“Expiry Date”) if they wish to stay invested in the existing constituent fund. If members do not reply before the Expiry Date, all their accrued benefits, investment instruction for future contributions and benefits transferred from other MPF schemes (“Future Investments”) will be invested according to DIS within 5 business days after the Expiry Date.

Members should send the Option 2 Form via channels listed in the table below. Otherwise, members may run at a risk that the Option 2 Form may not reach us or may reach us at a time later than what is expected; and in turn affect the investments of the accrued benefits and Future Investments.

The following table sets out the channels and cut-off time for receipt of the Option 2 Form. Any instruction received after the cut-off time will be considered as action taken after Expiry Date which may affect the accrued benefits and Future Investments to change to DIS.

# |

Channels |

Cut off Time for Instruction Received before Expiry Date |

Designated Address/Fax No. |

|---|---|---|---|

1 |

By mail (please use the enclosed pre-paid envelope and allow adequate time for postal delivery to ensure the reply slip can duly reach the stated address on or before the cut-off time) |

The instruction reaches the office premises of BestServe before 5:45pm on Expiry Date. |

BestServe Financial Limited (“BestServe”) 10/F., One Harbourfront, 18 Tak Fung Street, Hunghom, Kowloon, Hong Kong |

2 |

In person |

The instruction reaches the office premises of BestServe before 5:45pm on Expiry Date. |

BestServe Financial Limited (“BestServe”) 10/F., One Harbourfront, 18 Tak Fung Street, Hunghom, Kowloon, Hong Kong |

3 |

By Fax |

The instruction is received by the designated fax number by 11:59pm on Expiry Date. |

3183 1889 |

A confirmation will be sent to the members within 5 business days upon the completion of any switching and/or change of investment instruction. If members do not receive the confirmation from us, please contact us.

For further details on the points to note on the DRN that would be received by the relevant members, please click here.

E. Do I need to do anything?

If you have questions about the DIS, including how it will affect you and what necessary instruction should be sent to the Trustee, please contact our Sun Life Pension Services Hotline at 3183 1888 (for Sun Life Rainbow MPF Scheme).

Investment involves risks and past performance is not indicative of future performance. Investment return may rise as well as fall due to market condition and currency movement which may affect the value of investments. The value of units may vary due to changes in exchange rates between currencies. Emerging markets may involve a higher degree of risk than in developed markets and are usually more sensitive to price movements.

You are advised to read the MPF Scheme Brochure and the relevant marketing materials of the Scheme for further details and risk factors prior to making any investment decisions.

Issued by Sun Life Hong Kong Limited (Incorporated in Bermuda with limited liability)