【Semi-Private room medical coverage in Asia】Apply WeHealth Prestige to get 6 months premium rebate! Click here

CLIENT LOG ON

Please sign

Not registered? Register

By signing in, you agree to these terms and conditions.

- Please enter a search term.

Regions

-

You are on the Sun Life Financial Hong Kong website. Language selection is English. Expand or collapse region and language section. HONG KONG | 中文

-

Life Moments

Staying healthy

Preparing to retire

Enjoying retirement

Bright Tips

-

Insurance

Limited time offer

Value-added Services

- Overview

- Medical Concierge Services

- Local Urgent Care

- AdvicePro (Face-to-face Second Medical Opinion Services)

- Cashless Arrangement Service

- Mainland China VIP Medical Navigation Service

- Comprehensive Genomic Profiling

- Family Care Benefit

- Cancer and Stroke Family Support Program

- Worldwide Emergency Assistance Benefits

- Critical Illness Professional Assessment and Referral

- Overseas Medical Referral and Arrangement Service

Savings & Life

- Overview

- Fulfillment ratios of respective products

- Dividend and bonus philosophy of respective products

- FlexiRetire Annuity Plan

- Foresight Deferred Annuity Plan

- Generations II

- LIFE Brilliance

- One / Five Year Term Plan II

- Ruby Endowment Plan 3/8

- SaveFast Endowment Plan

- Stellar Multi-Currency Plan

- SunGift

- SunGift Global

- SunGuardian / SunGuardian (Care Version)

- SunJoy

- SunJoy Global

- SunProtect

- Venus II

- Victory

- Vision

- Vital

Voluntary Health Insurance Scheme (VHIS)

Medical & Critical Illnesses

Accident & Disability

Universal Life

Group Insurance

-

MPF & ORSO

ORSO fund prices & performance

* Sun Life MPF Master Trust has been merged into Sun Life Rainbow MPF Scheme from 30 August 2023

# Sun Life MPF Basic Scheme and Sun Life MPF Comprehensive Scheme have been merged into Sun Life Rainbow MPF Scheme from 29 November 2023

-

Invest

Quick links

Investment-linked Assurance Scheme

Asset Management

-

About us

Quick links

Who we are

Newsroom

Market Insights

Tools & Resources

- Overview

- Digital insurance experience

- My Sun Life HK Client Digital Platforms

- Retirement Calculator

- My Sun Life HK – Group Health app

- Education Budget Calculator

- Bright Solutions

- Cost estimator of treating major illnesses

- First Contribution Calculator

- Investment Risk Assessment

- Retirement Savings Calculator

- Expense Calculator

- Savings Planning Calculator

- Please enter a search term.

-

HONG KONG | 中文

Regions

RegionsLanguages -

Life Moments

-

Insurance

- Back

- Insurance

- Insurance overview

- Limited time offer

-

Value-added Services

- Back

- Value-added Services overview

- Medical Concierge Services

- Local Urgent Care

- AdvicePro (Face-to-face Second Medical Opinion Services)

- Cashless Arrangement Service

- Mainland China VIP Medical Navigation Service

- Comprehensive Genomic Profiling

- Family Care Benefit

- Cancer and Stroke Family Support Program

- Worldwide Emergency Assistance Benefits

-

Savings & Life

- Back

- Savings & Life overview

- Fulfillment ratios of respective products

- Dividend and bonus philosophy of respective products

- FlexiRetire Annuity Plan

- Foresight Deferred Annuity Plan

- Generations II

- LIFE Brilliance

- One / Five Year Term Plan II

- Ruby Endowment Plan 3/8

- SaveFast Endowment Plan

- Stellar Multi-Currency Plan

- SunGift

- SunGift Global

- SunGuardian / SunGuardian (Care Version)

- SunJoy

- SunJoy Global

- SunProtect

- Venus II

- Victory

- Vision

- Vital

- Voluntary Health Insurance Scheme (VHIS)

-

Medical & Critical Illnesses

- Back

- Medical & Critical Illnesses overview

- SunHealth Medical Care

- SunHealth Medical Essential

- SunHealth Medical Premier

- Critical Medical Care Insurance Plan II

- SunHealth Cancer Shield

- SunHealth LovePromise

- SunHealth UltraCare and SunHealth MaxiCare

- SunHealth OmniCare

- Hospital Income Insurance Plan

- SunWell Advanced Care and SunWell Supreme Care

- SunWell Essential Care

- Accident & Disability

- Universal Life

- Group Insurance

-

MPF & ORSO

- Back

- MPF & ORSO

- MPF & ORSO overview

- MPF Scheme

- ORSO Scheme

-

MPF fund prices & performance

- Back

- MPF fund prices & performance overview

- Sun Life Rainbow MPF Scheme price & performance

- Sun Life MPF Master Trust price & performance*

- Sun Life MPF Basic Scheme price & performance

- Sun Life MPF Comprehensive Scheme price & performance

- * Sun Life MPF Master Trust has been merged into Sun Life Rainbow MPF Scheme from 30 August 2023

- ORSO fund prices & performance

-

Invest

- Back

- Invest

- Invest overview

- Investment-linked Assurance Scheme

-

Investment-linked Fund Prices & Performance

- Back

- Investment-linked Fund Prices & Performance overview

- SunFortune

- SunArchitect

- SunWish

- SunFuture II

- SunFuture

- SunWealth

- SunAchiever

- FORTUNE Builder

- Rainbow Graduate

- Rainbow Retirement

- Rainbow Wealth Master

- ANNUITY 100 Retirement Plan

- FORTUNE

- Rainbow Saver/Rainbow Investor

- Star Select Investment Plan

- Asset Management

-

About us

- Back

- About us

- About us overview

- Who we are

- Newsroom

- Become an advisor

- Corporate responsibility

- Market Insights

- Become an employee

-

Tools & Resources

- Back

- Tools & Resources overview

- Digital insurance experience

- My Sun Life HK Client Digital Platforms

- MPF mobile app

- Retirement Calculator

- My Sun Life HK – Group Health app

- Education Budget Calculator

- Bright Solutions

- Cost estimator of treating major illnesses

- First Contribution Calculator

- Investment Risk Assessment

- Retirement Savings Calculator

- Expense Calculator

- Savings Planning Calculator

- Client support

-

Claims

- Contact us

- Chatbot “Sunny”- Terms & Conditions

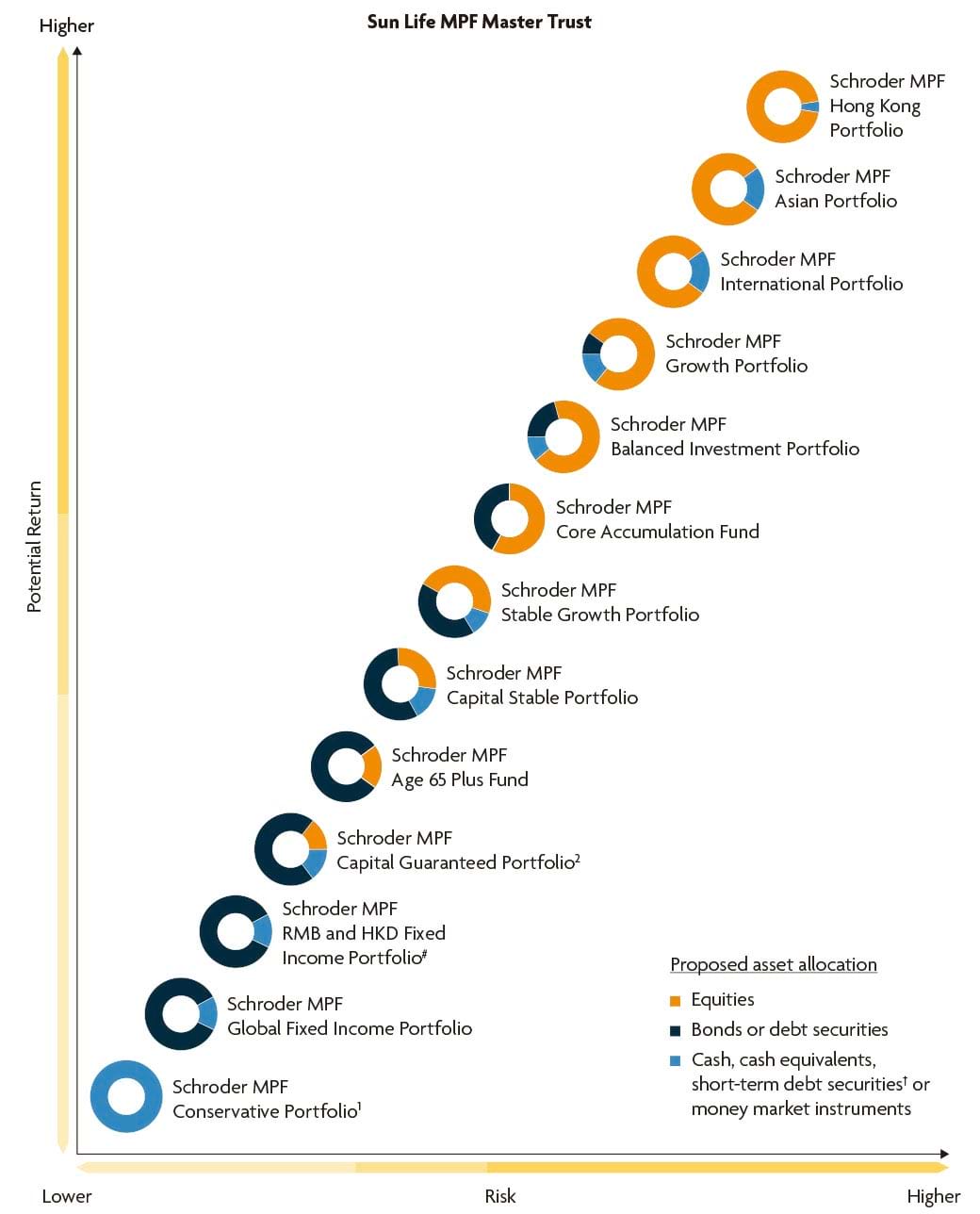

Sun Life MPF Master Trust

Our MPF product, namely “Sun Life MPF Master Trust”, adopts a specialist approach with the following professional investment services companies.

- Trustee and Custodian – HSBC Provident Fund Trustee (Hong Kong) Limited

- Administrator – BestServe Financial Limited

- Investment Manager – Schroder Investment Management (Hong Kong) Limited

- Sponsor – Sun Life Hong Kong Limited

Sun Life MPF Master Trust offers you a choice of 13 constituent funds, across the risk and return spectrum. These 13 constituent funds include: one conservative portfolio, two bond portfolios, one capital guarantee portfolio, six lifecycle portfolios and three equity portfolios. You can invest in different constituent funds according to your investment objectives and needs.

The above proposed asset allocation is for indicative purposes. Investors should note that the actual allocation may at times be varied from the proposed asset allocation in the MPF Scheme Brochure as market, economic and other conditions change.

†“Short-term debt securities” means (i) debt securities with a maturity of 1 year or less, with a credit rating level set by MPFA; or (ii) debt securities, with a maturity of 2 years or less issued by or guaranteed by specific issuers. For a list of specific issuers, please refer to Section 3.2.5.2 of the MPF Scheme Brochure

*Characteristics of constituent fund are determined by Schroder Investment Management (Hong Kong) Limited based on a number of factors relating to the underlying investments, including types of asset classes and their respective target weightings, and classification will be reviewed at least yearly by Schroder Investment Management (Hong Kong) Limited.

#Effective from 30 September 2015, the constituent fund was renamed from Schroder MPF HK Dollar Fixed Income Portfolio to Schroder MPF RMB and HKD Fixed Income Portfolio.

You can see below different constituent funds and their risk and potential return. These range from relatively conservative portfolios to higher growth/higher risk portfolios.

†"Short-term debt securities" means (i) debt securities with a maturity of 1 year or less with a credit rating level set by the MPFA; or (ii) debt securities with a maturity of 2 years or less issued by or guaranteed by specific issuers. For a list of specific issuers, please refer to Section 3.2.5.2 of the MPF Scheme Brochure.

#Effective from 30 September 2015, the constituent fund was renamed from Schroder MPF HK Dollar Fixed Income Portfolio to Schroder MPF RMB and HKD Fixed Income Portfolio.

Investors should note that the actual allocation may at times be varied from the proposed asset allocation in the MPF Scheme Brochure as market, economic and other conditions change.

Risk/potential return spectrum is determined by Schroder Investment Management (Hong Kong) Limited based on a number of factors relating to the underlying investments, including the exposure of equities, breadth and geographical diversification. The potential return and risk for each constituent fund is provided for reference only. The potential return does not represent the actual return and is not indicative of future performance. Investors should consider their own circumstances, including, without limitation, their own risk tolerance level, financial circumstances and investment objectives, before making any investment decisions. If you are in any doubt, you should seek independent professional financial advice.

Risk/potential return spectrum will be reviewed and, if appropriate, revised at least yearly by Schroder Investment Management (Hong Kong) Limited taking into account the prevailing market circumstances.

Please refer to Section 4.1 of the MPF Scheme Brochure of Sun Life MPF Master Trust for further details of the investment risks of the constituent funds.

The Fund Cruiser is generally applicable as the default investment arrangement for members who have a Pre-existing Account and who are aged 60 or above before 1 April 2017. For other members who hold a Pre-existing Account, please see paragraph Section 3.3.4 of the MPF Scheme Brochure of Sun Life MPF Master Trust for further details on the circumstances in which the Fund Cruiser may apply to Pre-existing Accounts.

The Fund Cruiser is also available as a separate investment choice to a member who chooses the Fund Cruiser as his investment instruction. The conditions for a member to invest in the Fund Cruiser are (i) giving an investment instruction to invest 100% of accrued benefits and contributions in an account into the Fund Cruiser and (ii) all of the accrued benefits in the relevant account are fully invested in the Fund Cruiser.

When you choose the Fund Cruiser, your balances and contributions will automatically be invested to the following arrangement according to your age. Your balances and contributions will also be switched automatically when you reach a different life stage.

Our Fund Cruiser aims to help you at your early working life to gain higher long-term potential investment return, and aims to help those who are close to retirement to reduce short-term investment risk. We assume that a fund with higher equity exposure potentially generates higher returns in the long run but with higher volatility in the short term, compared to a fund with lower equity exposure. For a younger member with a longer investment horizon, he/she can normally tolerate higher short term volatility.

Please note that each constituent fund is subject to market fluctuations and to the risks inherent in all investments and markets. As a result, the prices of units of the constituent funds and the income from units can go down as well as up. Switching of accrued benefits will be subject to risk of market fluctuation. The Trustee and the Investment Manager will have no responsibility for any investment losses sustained by any member as a result of the Fund Cruiser applied.

“Pre-existing Account” refers to an account which exists or is set up before 1 April 2017.

For more details about Fund Cruiser and Default Investment Strategy (“DIS”), please refer to the MPF Scheme Brochure of Sun Life MPF Master Trust or access Sun Life’s website at www.sunlife.com.hk to visit our DIS dedicated website.

Please refer to the MPF Scheme Brochure of Sun Life MPF Master Trust for details of other applicable fees, charges and expenses of the constituent funds.

^”Management fees” include fees paid to the trustee, custodian, administrator, investment manager (including fees based on fund performance, if any) and sponsor or promoter (if any) of a scheme for providing their services to the relevant fund. They are usually charged as a percentage of the net asset value of a fund. In the case of the DIS Funds management fees payable to the parties named above, or their delegates, can only (subject to certain exceptions in the MPF Ordinance) be charged as a percentage of the net asset value of a DIS Fund. These management fees are also subject to a statutory daily limit equivalent to 0.75% per annum of the net asset value of the relevant DIS Fund which applies across both the DIS Fund and its underlying approved pooled investment funds.

“DIS Funds” refers to the Schroder MPF Core Accumulation Fund and the Schroder MPF Age 65 Plus Fund and the “DIS Fund” means any of them.

Download the Product Summary of the Scheme

Check fund price and performance of the Scheme

Find a form

Note:

- Schroder MPF Conservative Portfolio does not guarantee the repayment of capital. Fees and charges of a MPF conservative fund can be deducted from either (i) the assets of the fund or (ii) member’s account by way of unit deduction. The Schroder MPF Conservative Portfolio uses method (i) and, therefore, unit prices / net asset value / fund performance quoted have incorporated the impact of fees and charges.

- Schroder MPF Capital Guaranteed Portfolio invests solely in an approved pooled investment fund in the form of insurance policy provided bySun Life Hong Kong Limited (“SLHK”). The guarantee is also given by SLHK. Your investments in the Schroder MPF Capital Guaranteed Portfolio, if any, are therefore subject to the credit risk of SLHK.

To qualify for the guarantee, a member must hold a beneficial interest at all times in the five year period, referred to as “continuous investment”. The guarantee will become effective: a) at the end of each five year period of continuous investment; and b) over a lesser period if the member reaches the age of 65. The guarantee will not apply in any other circumstances. After each five year period of continuous investment has occurred, a new period will begin as long as the member remains invested in this constituent fund. Any amount withdrawn or switched out from this constituent fund before the member is qualified for the guarantee is fully exposed to fluctuations in the actual market value of this constituent fund.

Please refer to section 3.2.5.1 and section 4.1 of the MPF Scheme Brochure of Sun Life MPF Master Trust for details of the credit risk, guarantee features and guarantee conditions. - Effective from 30 September 2015, the constituent fund was renamed from Schroder MPF HK Dollar Fixed Income Portfolio to Schroder MPF RMB and HKD Fixed Income Portfolio.

Disclaimer

Investment involves risks and past performance is not indicative of future performance. Investment return may rise as well as fall due to market condition and currency movement which may affect the value of investments. The value of units may vary due to changes in exchange rates between currencies. Emerging markets may involve a higher degree of risk than in developed markets and are usually more sensitive to price movements.

You are advised to read the MPF Scheme Brochure and the relevant marketing materials of Sun Life MPF Master Trust for further details and risk factors prior to making any investment decision.

Issued by Sun Life Hong Kong Limited (Incorporated in Bermuda with limited liability)

- Sun Life MPF Master Trust (the“Master Trust”) is a mandatory provident fund scheme.

- Investment involves risks and not all investment choices available under the Master Trust would be suitable for everyone. There is no assurance on investment returns and your investments/accrued benefits may suffer significant loss.

- You should consider your own risk tolerance level and financial circumstances before making any investment choices. When, in your selection of funds, you are in doubt as to whether a certain fund is suitable for you (including whether it is consistent with your investment objectives), you should seek financial and/or professional advice and choose the fund(s) most suitable for you taking into account your circumstances.

- Schroder MPF Capital Guaranteed Portfolio invests solely in an approved pooled investment fund in the form of insurance policy provided by Sun Life Hong Kong Limited (“SLHK”). The guarantee is also given by SLHK. Your investments in the Schroder MPF Capital Guaranteed Portfolio, if any, are therefore subject to the credit risk of SLHK. The guarantee available under the policy is also subject to certain conditions. Please refer to section 3.2.5.1 and section 4.1 of the MPF Scheme Brochure of the Master Trust for details of the credit risk, guarantee features and guarantee conditions.

- Members reaching 65th birthday or early retiring on reaching age 60 may apply (in such form and on such conditions as the Trustee may from time to time determine but subject to the Mandatory Provident Fund Schemes Ordinance and the Mandatory Provident Fund Schemes (General) Regulation (the “MPFS Regulation”)) for payment of the MPF Benefits in instalments. Please refer to section 6.3 of the MPF Scheme Brochure of the Master Trust for further details.

- You are advised to read the MPF Scheme Brochure and the relevant marketing materials of the Master Trust for further details and risk factors prior to making any investment decision.

MYMPFCHOICE.COM

If you want to compare the performance of different MPF constituent funds, please visit MyMPFChoice.com – a free performance comparative platform.

CONTACT US

At Sun Life Hong Kong, we aim to provide excellent customer service at all times.

Customer Service Hotline

(852) 2103 8928

Pensions Services Hotline

(852) 3183 1888

(For Sun Life Rainbow MPF Scheme)

(852) 2929 3029

(For Sun Life Rainbow ORSO Scheme)

Group Insurance Administration Hotline

(852) 3183 2099