Retiring at 40? Or work longer, live longer? You’ve probably heard plenty of stories of young couples retiring early to travel round the world. But you’ve probably also read about people working late into their 70s, or even starting new businesses. So, what is the ideal age to retire? Let the numbers guide you to an answer.

60, is the new 40?

Retiring early with enough money to enjoy life seems to be a trend nowadays, but what is the reality? In fact, the global trend is actually going in the opposite direction. And particularly in developed countries where the retirement age is getting older and older. There’s even a saying that “60, is the new 40”, which means that people in their 60s can still look forward to many new stages in their careers. The reason, for this is simply that populations are aging and people are living longer, and enjoying better health due to improved medical care, higher education levels, and lower birthrates, which all lead to people staying employed often long after 60.

“Happy countries” retiring at 67

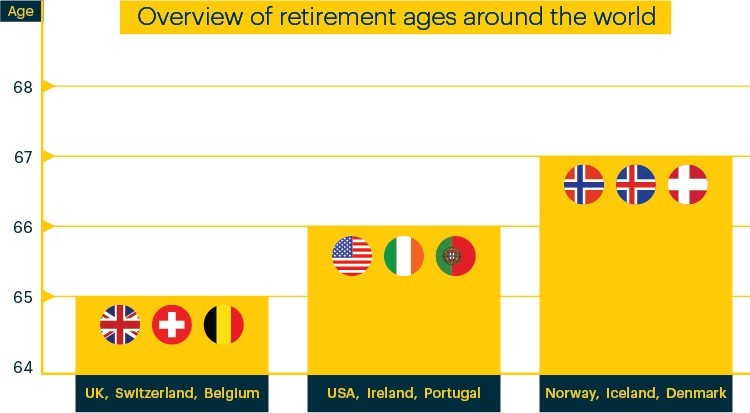

The statutory retirement age or pension age around the world is also increasing. The Nordic states – which are often considered the world’s happiest countries – are at the top of the list for later retirement at 67 (See chart 1). Other developed countries such as the USA, Switzerland, and Belgium are not far from behind, with retirement ages of 65 or above. As life expectancy rises, there is even an increasing tendency for different countries to postpone retirement even further.

Chart 1: Overview of retirement ages around the world

65 (UK, Switzerland, Belgium); 66 (USA, Ireland, Portugal); 67 (Norway, Iceland, Denmark)